financial statement analysis coursera week 4 quiz answers

Reconciliations Practice Quiz

1. Which of the following are types of source documents that might be needed to perform a vendor account reconciliation? Select ALL that apply.

- Order Reciept

- Credit Card Statement

- Invoices

- Bank Statement

2. The following are types of common errors except:

- Error of Omission

- Error of Original Entry

- Error of Law

- Error of Commission

3. True or False: All accounts can be reconciled.

- True

- False

Workflow Practice Quiz

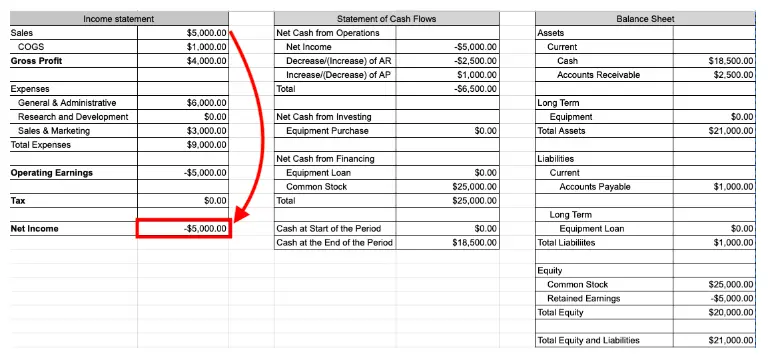

4. Upon reviewing the financial statements, you have determined that the sales revenue listed on the financial statements is incorrect and should actually be $15,000 instead of $5,000. Assuming all other accounts are accurate, what would the new net income be? (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

5000

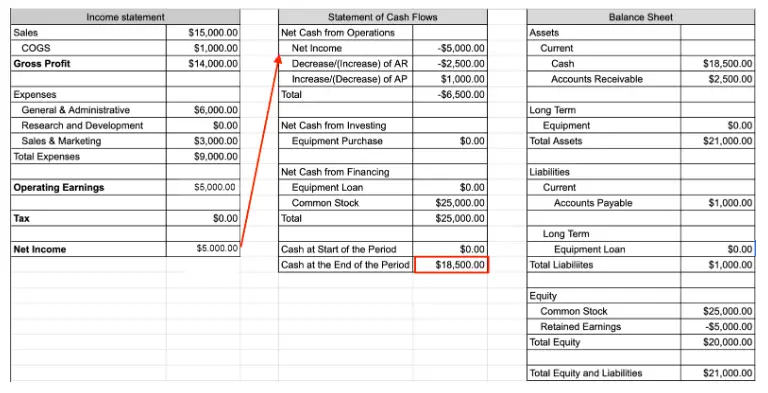

5. After reviewing and revising the income statement, you have determined that the new Net Income is now $5,000. Using this information, revise the Statement of Cash Flow to determine what the new Cash at the End of the Period would be? (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

28500

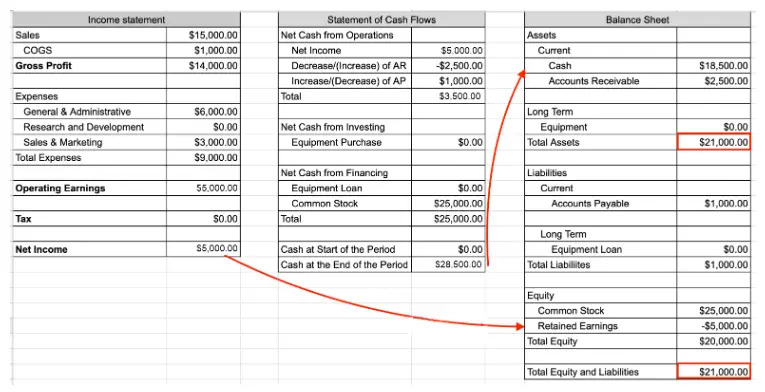

6. Now that the Income Statement and the Statement of Cash Flow are updated, the Balance Sheet needs to be updated. Using the new balances, revise the Balance Sheet to determine the new balances for the Total Assets and Total Equity and Liability. (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

31000

Key Reports Practice Quiz

7. If you wanted to view how much a company owes and if payments are overdue, which report group would you run?

- Customers and Receivables

- Jobs, Time, and Mileage

- Company and Financial

- Vendors and Payables

8. Which ratio would you calculate to view a business's capacity to generate adequate income to repay interest on its debt?

- Debt to Asset Ratio

- Coverage Ratio

- Cash Ratio

- Return on Total Assets Ratio

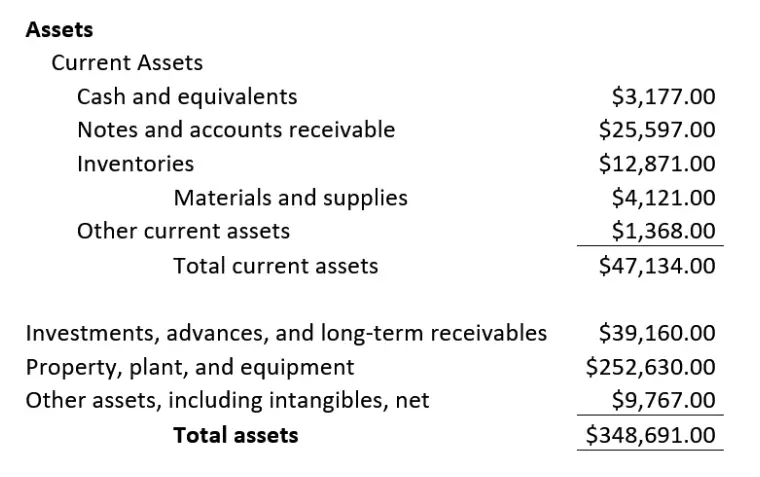

9. Using the following balance sheet, calculate the Return on Assets ratio using the total assets for the average. (enter your answer as a decimal and round to the nearest thousandths, example x.xxx)

Income from Operations as found on the income statement was $19,710.

0.057

Reconciliations and Financial Analysis Assessment

10. When completing the reconciliation form, what amount should be listed as the (+/-) adjustment to BOOKS on the balance per book's side?

- $1,000

- $174.23

- $449.23

- $275.00

11. Which of these accounts was not impacted by the 3/26/20 journal entry?

- Inventory

- Note Payable

- Interest Expense

- Cash

12. Selling expenses in March were more than double February's amount. What might be the reason?

- The business mistakenly made two loan payments in one month

- The tax rate increased

- The business sold more computers

- The business made a large investment in social media marketing

13. On the Balance Sheet for March 31, what was Circuit Computer's Accounts Receivable balance? (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

14. Accounts Payable had a beginning balance that was a Debit balance. What might this mean?

- None of these

- Their supplier gave them a refund or account credit

- They are behind on their payments

- Their customer has not paid yet

15. Which of these equations should be used to calculate Circuit Computer’s debt-to-equity ratio on March 31?

- $204,000 / $291,000 = debt-to-equity ratio

- $204,000 / $87,000 = debt-to-equity ratio

- $291,000 / $87,000 = debt-to-equity ratio

- $291,000 / $204,000 = debt-to-equity ratio

16. Which month in Q1 produced the highest gross profit?

- March

- January

- February

17. What was the operating margin in February? (enter your answer as the percentage, without the sign, and round to the nearest hundredth, example xx.xx)

18. Which month in Q1 produced the highest net margin ratio?

- March

- January

- February

19. The owner of Circuit Computers doesn’t understand why the Cash Account balance doesn’t match the Net Profit on the P&L. Which statement or report would you review to help you answer this question?

- Statement of Cash Flows

- Sales Tax Liability

- Balance Sheet

- Sales by Customer

20. During the completion of the bank statement reconciliation, what type of errors were found during the process?

- Errors of Principle

- Data Entry Errors (transposition)

- Errors of Omission

- Errors of Commission

21. What may be a reason the ACH Amazon Refund deposit on 3/30/20 was missed on the books? (Select ALL that apply)

- The owner may not have communicated that a return had been made, making it an unanticipated future transaction

- The return may have happened last month, but not been refunded until now. The notation was forgotten when the new month’s books were started

- Automatic deposits and/or transactions are easy to overlook if they are not regularly scheduled events like payroll or loan payments

- Circuit Computer’s bookkeeper is on a leave of absence and you’re filling in. Maybe the other bookkeeper knew to anticipate this transaction, but you wouldn’t have known

22. IF Circuit Computers wrote a check for $12,000 to a vendor for additional supplies on 03/28/20 that had not cleared yet. Where would this be put on the bank reconciliation form that was completed on 3/31/20?

- Balance per Books side, Company error

- Balance per Bank side, Deposits in transit

- Balance per Bank side, Outstanding checks

- Balance per Books side, Fees/Returned checks

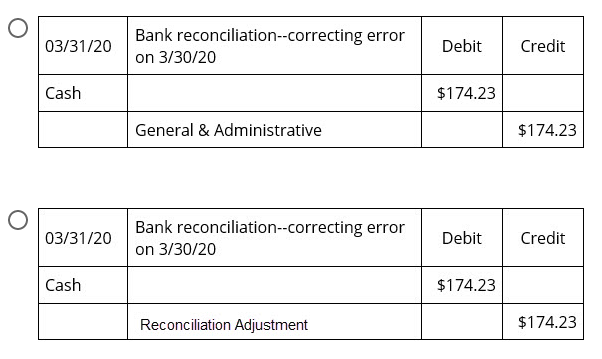

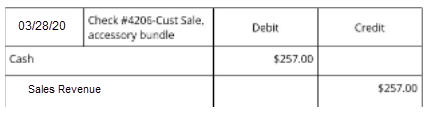

23. If the check deposited on 3/28/20, in the case study workbook, was recorded with the Cash and Revenue portion as seen below instead, which of the following would be true? (Select ALL that apply)

- The cash account would be short $18

- The cash account would be overstated by $18

- The error could be corrected by a single journal entry

- A transposition error would have occurred