liabilities and equity in accounting coursera week 2 quiz answers

Sales Tax Liability Practice Quiz

1. In the same state, shoes, bananas, and a haircut would all be subject to the same sales tax rate.

- False/ It depends

- True

2. Funds in the Sales Tax Payable account can be treated as if they were Sales Revenue.

- True

- False

3. A customer purchases a pair of leopard spot fuzzy dice for $30 and the purchase is subject to 8% tax.

What’s the total amount Crankshaft Customs should collect from the customer? (Format your answer as $xx.xx)

- $32.40

- $32.08

- $30.80

- $38.00

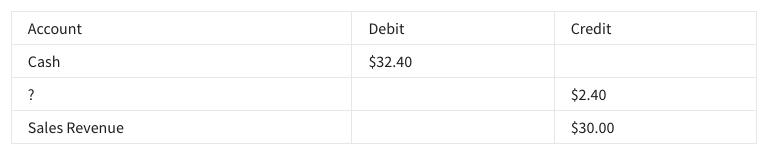

4. Which account is missing in this journal entry for the $32.40 sale that includes $2.40 in tax?

- Inventory

- Sales Tax Payable

- Accounts Receivable

- Sales Tax Receivable

5. Which feature of accounting software can provide information about how much sales tax is owed to each tax agency?

- Sales Tax Liability Report

- Customer Summary Report

- Bill Payments List

- Profit and Loss by Month

Matching Principle and Payroll Practice Quiz

6. A salesperson makes a 5% commission on every sale they make in the month of January, but their commission isn't paid until February. This means that if they sell $100 worth of products in January, the company will pay them $5 in February.

When will the commission be recorded on the books?

- January

- February

7. An employee earns a bonus of $10,000 in 2019 based on their performance in the workplace. The bonus isn't paid out to them until 2020.

When will the bonus be recorded on the income statement?

- 2019

- 2020

8. Let's say a full time hourly employee’s pay period ends on April 20th, but they didn’t get paid until May 3rd. This expense needs to be recorded in which month?

- April

- May

Shuffle Q/A 1

Payroll Practice Quiz

9. The following could be payroll deductions on an employee’s paystub, except:

- SUTA

- Health insurance

- FICA

- Garnishment

10. The following are reasons for running payroll reports, except:

- They help inform decision making and tracking

- You might need to issue a report on a specific employee if there is a dispute on hours paid

- You might be asked to update the business owner on the cost of payroll

- They produce financial statements that are helpful