assets in accounting coursera week 1 quiz answers

Categorize These Assets

1. Which of these would be considered a current asset? Select 2.

(select ALL that apply, if you don't it will not give you the point)

- Accounts receivable

- Prepaid expenses

- Accumulated depreciation

- Vehicle

2. How would you categorize $3,500 worth of computer equipment that the business will use as part of its operations?

- Current assets

- Long-term assets

- Equity

Reading Quiz

4. Accountants consider prepaid rent ______________ on your financial statements.

- A liability

- An asset

Assets Practice Quiz

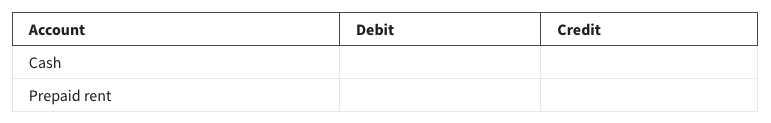

6. Rent for Eternal Summer is $1,200/month, but if it is prepaid, rent is only $12,000 for the year. If Eternal Summer pays $12,000 on January 1, how would you book this transaction?

- Debit Cash for $12,000 and Credit Prepaid rent for $12,000.

- Debit Prepaid rent for $12,000 and Credit Cash rent for $12,000.

7. What happens on Feb 1? Remember that $1,000 (1/12) of the $12,000 Prepaid rent has been “used up” or realized as an expense during January.

So we need to _____ Prepaid rent (asset account) and _____ Rental expense (expense account)

- Debit, Credit

- Credit, Debit

8. What would the balance in the Prepaid rent account be on May 1?

- $11,000

- $10,000

- $9,000

- $8,000

Shuffle Q/A 1

9. If we run a Profit & Loss (or Income Statement) for Eternal Summer for the month of April, which of these would appear on the statement?

- Rental Expense $1,000.

- Prepaid rent $8,000.

10. If we create a Balance Sheet for Eternal Summer on May 1st, which of these would appear on the statement?

- Rental Expense $1,000

- Prepaid Rent $8,000