bookkeeping basics coursera week 2 answers

General Ledger Practice Quiz

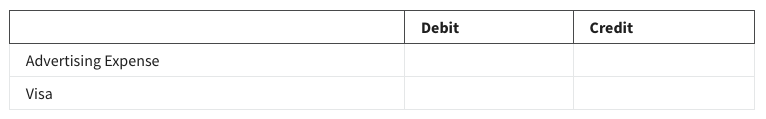

1. Lou pays $100 to advertise in his local mailer and puts the charge on his Visa credit card.

Which two accounts are involved in this transaction?

- Visa, Advertising revenue

- Visa, Equipment

- Visa, Advertising expense

- Visa, cash

2. To record the journal entry, we will ____ the advertising expense account and _____ the Visa account.

- Credit, credit

- Credit, debit

- Debit, credit

- Debit, debit

3. To post a debit to the advertising expense ledger, we would record $100 on the ___ side.

- Left

- Right

- Depends on the situation

4. This ledger shows all transactions impacting the cash account this week.

Calculate the balance.

- $150

- $250

- $300

- $450

5. On the chart of accounts, which account would you find under liabilities?

- Equipment

- Landscaping Income

- Vehicle loan

- Paid-in capital

Journal Entries Practice Quiz

6. True or False: Journal entries require a good understanding of debits and credits.

- True

- False

7. When would it be acceptable to use Manual Journal entries to hide or disguise certain financial transactions?

- When the owner asks you to.

- Never.

- When you need to balance the assets against the liability and equity.

Shuffle Q/A 1

9. Who should decide what to manually enter into general journal entries?

- Accountant

- Owner (who is not an accountant)

- Bookkeeper