financial statement analysis coursera week 3 quiz answers

Income Statement Analysis Practice Quiz

1. John Jacob's company recorded $60,000 in sales revenue and a cost of goods sold of $45,000 on their income statement this month. What is their percentage Gross Profit Margin? (Enter the answer as a whole number and without the % sign)

25

2. Sally's Seashells company Income Statement shows that they have a Sales Revenue of $60,000 and Operating Earnings of $11,000. What is their percentage Operating Profit Margin? (Enter the answer as a whole number and without the % sign)

18

3. Harry's Wizarding Wands company recorded a net profit of $8,500 in addition to their Sales Revenue of $60,000 on their recent income statement. What is their Net Profit Margin? (Enter the answer as a whole number and without the % sign)

14

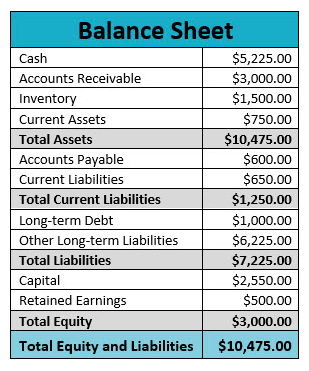

Balance Sheet Practice Quiz

4. What does the debt to equity ratio evaluate?

- What proportion of equity a company is using to finance its profits

- What proportion of debt or equity a company is using to finance its assets

- A company’s debt as a percentage of total liabilities and owner’s equity amount

5. If a company has $30,000 debt and $60,000 equity, what is its debt to equity ratio?

- 0.2

- 5.0

- 0.5

- 2.0

6. Which of the following statements is incorrect?

- The higher the debt-to-equity ratio, the more profit the company has recorded

- A high debt-to-equity ratio means the company has a lot of debt in relation to the equity

- The higher the debt-to-equity ratio, the more debt the company has on its balance sheet

- The debt-to-equity ratio analyzes the relationship between total liabilities and total equity

7. True or False: Generally, a high AP ratio indicates that you satisfy your accounts payable obligations quickly.

- True

- False

Cash Flow Practice Quiz

8. DigiWidgit recorded operating cash flows totaling $152,000 and the total debt payable for the year was $77,000 What is their Cash Flow Coverage Ratio? (Enter your answer to the one-hundredth position, x.xx)

1.97

9. Vegg Delivery recorded current liabilities of $44,000 at the year’s start, current liabilities of $67,000 at year’s end, and Cash Flow from Operating Activities of $120,000. What is their Current Liability Coverage Ratio? (enter your answer to the one-hundredth position, x.xx)

2.16

10. Superior Suits recorded a cash flow from operations of $48,750 and net sales of $87,000. What is their Operating Cash Flow Margin ratio? (enter your answer to the one-hundredth position, x.xx)

0.56

Business Communications Practice Quiz

11. Suppose one of your bookkeeping clients has stated they prefer to have a conversation around their financial statements, not simply receive an email. What communication channels might you use? (select all that apply)

- Phone calls

- Face-to-face meetings

- Webconference

- Text message

12. What does KPI stand for in accounting?

- Key Performance Indicator

- Key Partner Index

- Key Partner Information

13. Which of the following would be the best and most professional subject line to use when you want to ensure the client reads and responds to a request?

- Action Requested: Please Review and Provide Signature

- READ THIS RIGHT NOW

- Please sign this and return it by end of business next Wednesday, or I will not be able to move forward

- Bookkeeping Update

Analyzing Key Reports and Transactions Assessment

14. Gross Profit Margin shows the percentage of revenue that:

- Exceeds the cost of goods sold (COGS)

- How much profit a company makes on a dollar after paying for expenses and overhead

- The percentage of profit a company produces from its total revenue

15. Lou's Tavern recorded $60,000 in sales revenue and a cost of goods sold of $45,000 on their income statement this month. What is their Gross Profit Margin? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

0.25

16. Net profit margin shows the percentage of:

- Profit a company makes on a dollar after paying for expenses and overhead

- Revenue that exceeds the cost of goods sold (COGS)

- Profit a company produces from its total revenue

17. On Marla's Laundromat Income Statement there is a Sales Revenue of $60,000 and Operating Earnings of $11,000. What is their Operating Profit Margin? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

0.18

18. Tyler's Theater recorded a net profit of $8,500 in addition to their Sales Revenue of $60,000 on their recent income statement. What is their Net Profit Margin? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

0.14

20. What does the debt to equity ratio evaluate?

- What proportion of debt or equity a company is using to finance its assets

- A company’s debt as a percentage of total liabilities and owner’s equity amount

- What proportion of equity a company is using to finance its profits

21. If a company has $30,000 debt and $60,000 equity, what is its debt to equity ratio? (enter your answer as a decimal and round to the nearest tenth, example x.x)

0.5

22. When is a high debt to equity ratio be positive for a company's financial health and share price?

- If the earnings growth that the borrowed money generates is HIGHER than the cost of borrowing it

- If the company does not borrow any money

- If the earnings growth that the borrowed money generates is LOWER than the cost of borrowing it

23. Which of the following statements is incorrect?

- The higher the debt-to-equity ratio, the more debt the company has on its balance sheet

- The higher the debt-to-equity ratio, the more profit the company has recorded

- The debt-to-equity ratio analyzes the relationship between total liabilities and total equity

- A high debt-to-equity ratio means the company has a lot of debt in relation to equity

24. True or False: Generally, a high AP turnover ratio indicates that you satisfy your accounts payable obligations quickly.

- True

- False

25. The Cash Flow Coverage Ratio measures _________.

- how well a company can pay its expenses

- how well a company converts sales to cash

- company solvency

- a company’s ability to pay its short-term obligations

26. The cash flow margin ratio demonstrates _________.

- how well a company produces cash from its total revenue

- how well a company converts sales to cash

- a company’s ability to pay its short-term obligations

- company solvency

27. DigiWidgit recorded operating cash flows totaling $152,000 and the total debt payable for the year was $77,000 What is their Cash Flow Coverage Ratio? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

1.97

28. Daryl's Delivery recorded current liabilities of $44,000 at the year’s start, current liabilities of $67,000 at year’s end, and Cash Flow from Operating Activities of $120,000. What is their Current Liability Coverage Ratio? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

2.16

29. Superior Suits recorded a cash flow from operations of $48,750 and net sales of $87,000. What is their Operating Cash Flow Margin ratio? (enter your answer as a decimal and round to the nearest hundredth, example x.xx)

0.56