assets in accounting coursera week 1 quiz answers

Categorize These Assets

1. Which of these would be considered a current asset? Select 2.

(select ALL that apply, if you don't it will not give you the point)

- Accounts receivable

- Prepaid expenses

- Accumulated depreciation

- Vehicle

2. How would you categorize $3,500 worth of computer equipment that the business will use as part of its operations?

- Current assets

- Long-term assets

- Equity

Reading Quiz

3. In prepaid expense accounting, these expenses are ________ assets.

- Current

- Non-current

4. Accountants consider prepaid rent ______________ on your financial statements.

- A liability

- An asset

Assets Practice Quiz

5. To book Prepaid Expenses, you must be using which type of accounting method?

- Cash

- Accrual

6. Rent for Eternal Summer is $1,200/month, but if it is prepaid, rent is only $12,000 for the year. If Eternal Summer pays $12,000 on January 1, how would you book this transaction?

- Debit Cash for $12,000 and Credit Prepaid rent for $12,000.

- Debit Prepaid rent for $12,000 and Credit Cash rent for $12,000.

7. What happens on Feb 1? Remember that $1,000 (1/12) of the $12,000 Prepaid rent has been “used up” or realized as an expense during January.

So we need to _____ Prepaid rent (asset account) and _____ Rental expense (expense account)

- Debit, Credit

- Credit, Debit

8. What would the balance in the Prepaid rent account be on May 1?

- $11,000

- $10,000

- $9,000

- $8,000

9. If we run a Profit & Loss (or Income Statement) for Eternal Summer for the month of April, which of these would appear on the statement?

- Rental Expense $1,000.

- Prepaid rent $8,000.

10. If we create a Balance Sheet for Eternal Summer on May 1st, which of these would appear on the statement?

- Rental Expense $1,000

- Prepaid Rent $8,000

11. Which of these would be considered a current asset? (select all that apply)

- Accounts receivable

- Prepaid expenses

- Accumulated depreciation

- Vehicle

12. How would you categorize $3,500 worth of computer equipment that the business will use as part of its operations?

- Current assets

- Long-term assets

- Equity

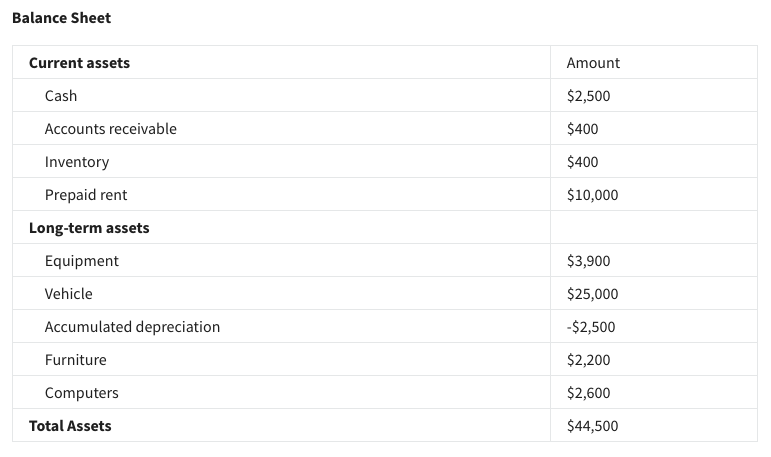

13. Use the balance sheet pictured to answer the following question.

If Eternal Summer purchased $500 worth of Inventory using Cash, what would the total assets be after the transaction?

- $44,000

- $44,500

- $45,000

14. Use the balance sheet pictured to answer the following question.

If Eternal Summer purchased $500 worth of Inventory using their supplier credit line, what would the total assets be after the transaction?

- $44,000

- $44,500

- $45,000

15. Use the balance sheet pictured to answer the following question.

If the accumulated depreciation for Eternal Summer’s mobile massage van increases to $3,000, what would the Total Assets balance be after this entry?

- $44,000

- $44,500

- $45,000

Sales Practice Quiz

16. Which path would you select in QuickBooks Online to create a sales receipt?

- New > Invoice

- New > Receive payments

- New > Sales receipt

- New > Pay bills

17. Which piece of information is not mandatory to record a sales receipt?

- Cost of items purchased

- Payment method

- Customer name

- Items sold

18. Which account keeps a record of payments in QuickBooks until you physically deposit the same payments at your real-life bank?

- Undeposited funds

- Accounts payable

- Petty cash

- Accounts receivable

19. When creating an invoice in QuickBooks Online, which path would you choose to add a new customer?

- Save and Send > End

- Start > New

- Customer > Add New

- You don’t have to add customer information

20. Sophia does a guest lecture on small business marketing at the Conference of Marketing to Scale. She invoiced the organizers for $200 and their check just arrived in the mail.

To record the payment, which path would you select in QuickBooks Online?

- New > Receive payments

- New > Pay bills

- New > Sales receipt

- New > Invoice

21. When you record a sales receipt or invoice for $500, the accounting software will automatically credit the relevant __________ by $500.

- Revenue account

- Expense account

- Liability account

- None of these

Promissory Notes Practice Quiz

22. In bookkeeping, a signed agreement between two parties, used to document money owed, interest, and payment timeframe is known as what?

- Bad Debt

- Notes Receivable

- General Ledger

- Promissory Note

23. True or False. The Direct Write-Off method of accounting for “Bad Debt” adheres to the matching principle.

- True

- False

24. Notes Receivable is money that is owed to that company and is therefore classified as ______?

- Asset

- Liability

- Equity

Accounting Concepts and Measurement Assessment

25. True or False. An accumulated depreciation account is considered an account with a natural credit balance, meaning the account increases with debits and decreases with credits.

- True

- False

26. Suzie Santo owns “Chiquita Chihuahua”, a boutique pet supplies store with customized canine offerings. She has a vendor, “Paws Free”, that supplies her with high-end carrying cases for small dogs. Suzie ordered $8000 worth of cases for the upcoming travel season on credit, but didn’t plan on a pandemic shutting down all travel and not to mention her business for 6 months. She contacts Ricky at “Paws Free'' to work out an arrangement to settle her account. What type of document is used for this type of agreement?

- Trial Balance

- Notes Payable

- Notes Receivable

- Promissory note

27. Suzie agrees to pay Ricky the $8,000 in 2 months, at 15% interest. Which of the following is the most accurate way Ricky and Suzie should record this event on each of their balance sheets?

- Ricky will record $9,200 as a Notes Receivable, Suzie will record $9,200 as a Notes Payable.

- Ricky will add $8,000 as a Notes Payable and Suzie will add $8,000 as a Notes Receivable.

- Ricky will add $9,200 as a Cash deposit, and Suzie will record $9,200 as a Notes Payable.

- Ricky will record the balance as a Notes Receivable and Suzie will list the $8,000 as a Notes Payable.

28. Continuing with our example, would Ricky’s notation on the balance sheet fall under the asset or liabilities column?

- Liability

- Asset

29. Would Suzie record this transaction as an asset or a liability on her balance sheet?

- Asset

- Liability

30. Suzie has agreed to pay Ricky back the outstanding balance of $8,000 over the course of 2 months at 15% interest, and have both signed the promissory note.

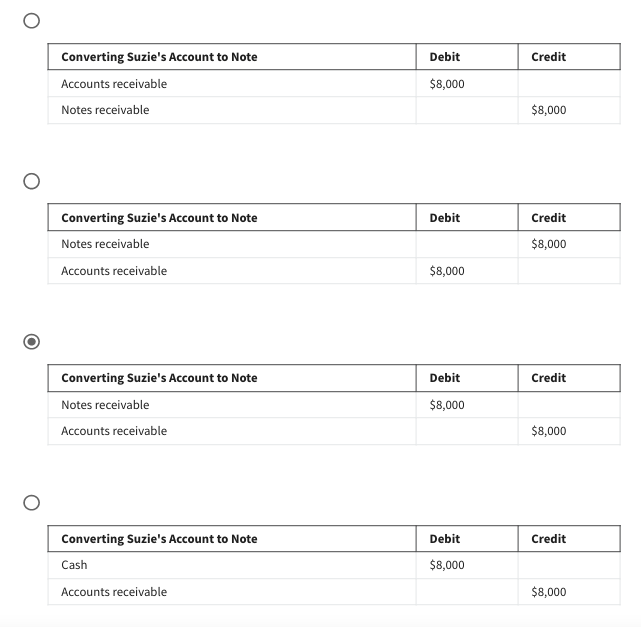

Which of the following is the best example of how Ricky should initially record this in his General Journal?

31. Suzie is ready to make her first payment to Ricky. She is planning on paying $4000 plus her accrued interest.

Using the formula Principal X Interest X 30/365, what would Suzie's total first payment be?

(Enter the full amount as $XXX.XX)

32. Suzie is ready to make her second and final payment of $4,000 plus interest to Ricky.

Using the formula Principal X Interest X 30/365, what would Suzie’s total second and final payment be?

$4,049.32

33. Which Promissory Note component would be entered in section [ 3 ] of the statement below?

I, [_1_], agree to pay [_2_] the following amount of [_3_] with interest at [_4_], by [_5_].

- Maker

- Principal Value

- Payee

- Stated Interest

- Time Frame

34. Which Promissory Note component would be entered in section [ 1 ] of the statement below?

I, [_1_], agree to pay [_2_] the following amount of [_3_] with interest at [_4_], by [_5_].

- Maker

- Time Frame

- Payee

- Principal Value

- Stated Interest

35. Which Promissory Note component would be entered in section [ 5 ] of the statement below?

I, [_1_], agree to pay [_2_] the following amount of [_3_] with interest at [_4_], by [_5_].

- Payee

- Principal Value

- Maker

- Stated Interest

- Time frame

36. Katie runs an ice cream shop called “Cream and Cone,” and has made her mark by selling flavored sugar cones to enhance her customers' enjoyment of all the unique flavors of ice cream. She notices that her Maple-Bacon sugar cone is a hot item, especially when paired with a scoop of Bourbon-Butter Pecan. She has decided to trademark this signature cone and use it as her brand’s star item. She’s calling it her ‘Maple-Bacon Bourbon Blast’. Her new trademark is considered what kind of asset?

- Non-current

- Tangible

- Intangible

- Current

37. Roger owns a food delivery service that uses couriers on electric skateboards to deliver locally in the business district. His skateboards which are valued at $2,700 are considered which of the following?

- Inventory

- Current asset

- Long-term asset

- Bad Debt

38. Which of the following is correct?

- Total Assets + Total Liabilities = Total Equity

- Total Assets = Total Liabilities + Total Equity

- Total Equity – Total Liabilities = Total Assets

- Total Liabilities – Total Assets = Total Equity

39. True or False. A prepaid expense such as prepaid rent or insurance is initially classified as a liability.

- False

- True

40. A copyright is an example of what type of asset?

- Tangible asset

- Intangible asset

- Current asset

- Long term asset

41. What do bookkeepers do when they don’t know how to book something? Select all that apply.

- They ask for help from a best friend.

- They ask the business owner for more clarification.

- They make their best guess based on the information they have.

- They ask a fellow bookkeeper or accountant.

- They research online.

42. True or False. The Direct Write-Off Method adheres to the matching principle because it lets businesses write off debt that is believed to be uncollectible.

- False

- True

43. When a customer purchases something by cash or check, before it’s deposited into the bank, which account should it be entered into?

- Accounts Receivable

- Petty Cash

- Inventory

- Undeposited Funds

44. If a customer or vendor buys something on credit, but hasn’t made a payment in over 30 days, which receivable account should be used?

- “Doubtful” Receivable

- “Aging” Receivable

- Accounts Uncollectible

- Accounts Receivable