bookkeeping basics coursera week 2 answers

General Ledger Practice Quiz

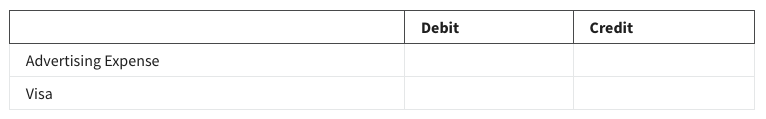

1. Lou pays $100 to advertise in his local mailer and puts the charge on his Visa credit card.

Which two accounts are involved in this transaction?

- Visa, Advertising revenue

- Visa, Equipment

- Visa, Advertising expense

- Visa, cash

2. To record the journal entry, we will ____ the advertising expense account and _____ the Visa account.

- Credit, credit

- Credit, debit

- Debit, credit

- Debit, debit

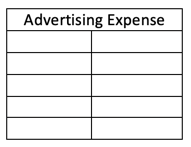

3. To post a debit to the advertising expense ledger, we would record $100 on the ___ side.

- Left

- Right

- Depends on the situation

4. This ledger shows all transactions impacting the cash account this week.

Calculate the balance.

- $150

- $250

- $300

- $450

5. On the chart of accounts, which account would you find under liabilities?

- Equipment

- Landscaping Income

- Vehicle loan

- Paid-in capital

Journal Entries Practice Quiz

6. True or False: Journal entries require a good understanding of debits and credits.

- True

- False

7. When would it be acceptable to use Manual Journal entries to hide or disguise certain financial transactions?

- When the owner asks you to.

- Never.

- When you need to balance the assets against the liability and equity.

8. True or False: Journal entries should not be used during year-end adjustments.

- True

- False

9. Who should decide what to manually enter into general journal entries?

- Accountant

- Owner (who is not an accountant)

- Bookkeeper

10. True or False: Journal entries should not be used to enter depreciation.

- True

- False

Accounting Cycle Practice Quiz

11. What is the first step in the accounting cycle?

- Preparing financial statements

- Making adjustments

- Posting transactions to the general ledger

- Reviewing source documents and analyzing transactions

12. True or False: The unadjusted trial balance should be used to create financial statements.

- True

- False

13. What is the name of the form or statement that lists the profit or loss for a company during a specific period?

- The balance sheet

- The trial balance

- The income statement

- The general journal

Accounting Cycle (Part 1) Assessment

14. A schedule that contains all accounts needed to prepare financial statements is known as:

- An Income Statement

- The General Ledger

- A Journal Entry

15. Reorganizing journal entries and grouping them by account is known as:

- File maintenance

- Posting to the ledger

- Balancing the journal

16. A listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger is known as a:

- Chart of Accounts

- Journal Entry

- Financial Statement

17. To find the balance of the account types that increase with a debit (asset and expense accounts), bookkeepers will:

- Subtract total credits from total debits (Debits – Credits)

- Subtract total debits from total credits (Credits – Debits)

18. The accounting cycle starts with the:

- Preparation of adjusting entries

- Preparation of ledger accounts

- Preparation of a trial balance

- Analysis of business transactions

19. After analysis, the business transaction is recorded in the journal in:

- Chronological order

- Random order

20. A form or statement that lists the titles and balances of all ledger accounts at a given date is known as:

- Trial balance

- Statement of retained earnings

- Income statement

- Balance sheet

21. Sydney is entering a transaction in QuickBooks. What are the two steps of manual accounting that will happen simultaneously as she does this?

- Entering an expense and entering revenue

- Creating a journal entry and posting to the ledger

- Creating a journal entry and producing a profit and loss statement

22. The digits of the account numbers assigned to general ledger accounts often have significance. For example, an account number beginning with a "1" might signify that the account is an asset account, a "6" might signify an operating expense, etc.

- True

- False

23. A trial balance where total debits equal total credits indicates:

- One or more transactions have been incorrectly analyzed and recorded in the ledger accounts.

- The ledger is in balance.

- The company made a profit during the accounting period.

24. Zach needs to determine what his company’s financial position was on March 31st of last year. Which of the following would be the best report to look at?

- Statement of retained earnings

- Balance sheet

- Statement of equity

- The general ledger

25. Which of the following financial statements reports the sources and uses of cash by a business?

- The Income Statement

- Statement of Cash Flow

- The Balance Sheet

- Statement of Equity

26. Which of the following lists general ledger account balances at the end of a reporting period, before any adjusting entries are made?

- Unadjusted Trial Balance

- Statement of Equity

- Adjusted Trial Balance

- The Balance Sheet

27. A trial balance that is prepared after taking into account all the adjusting entries is known as:

- Adjusted Trial Balance

- Cash Flow Statement

- Unadjusted Trial Balance

28. The preparation of financial statements and closing the books is the ______ step of the accounting cycle.

- third

- second

- fourth

- last

29. Rudiger has just recorded and posted his business transactions to the ledger. His next step in the accounting cycle is to _______.

- prepare the income statement

- analyze transactions

- prepare an unadjusted trial balance

- collect all receipts and invoices

30. Francis enters a $100 check received from a customer into QuickBooks online. If she views the Transaction Journal, which account would show as being debited $100?

- Revenue

- Expenses

- Business bank account

- Accounts receivable

31. The double-entry system of bookkeeping normally results in which of the following balances in the ledger accounts?

Debit: Assets and revenue

Credit: Liabilities, equity, and expenses

Debit: revenue, capital, and liabilities

Credit: Assets and expenses

Debit: Assets and expenses

Credit: Liabilities, equity, and revenue

Debit: Assets, expenses, and capital

Credit: Liabilities and revenue

32. In the first month of operations, Pepper Consulting’s total debit entries to the cash account amounted to $900, and the total credit entries to the cash account amounted to $600. The cash account has a:

- $600 credit balance

- $300 credit balance

- $900 debit balance

- $300 debit balance

33. Pepper Consulting bought computers with credit from PYO Suppliers and entered the purchase into QuickBooks. The transaction journal for Pepper Consulting would show the following entry:

Debit: Sales

Credit: computers

Debit: PYO Credit Payable

Credit: Computers

Debit: Computers

Credit: PYO Credit Payable

Debit: Computers

Credit: Sales