liabilities and equity in accounting coursera week 2 quiz answers

Sales Tax Liability Practice Quiz

1. In the same state, shoes, bananas, and a haircut would all be subject to the same sales tax rate.

- False/ It depends

- True

2. Funds in the Sales Tax Payable account can be treated as if they were Sales Revenue.

- True

- False

3. A customer purchases a pair of leopard spot fuzzy dice for $30 and the purchase is subject to 8% tax.

What’s the total amount Crankshaft Customs should collect from the customer? (Format your answer as $xx.xx)

- $32.40

- $32.08

- $30.80

- $38.00

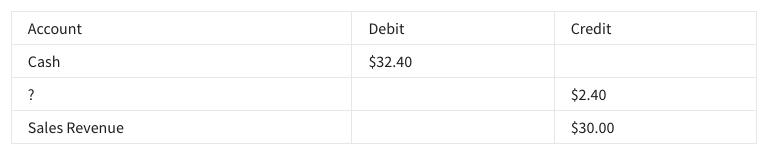

4. Which account is missing in this journal entry for the $32.40 sale that includes $2.40 in tax?

- Inventory

- Sales Tax Payable

- Accounts Receivable

- Sales Tax Receivable

5. Which feature of accounting software can provide information about how much sales tax is owed to each tax agency?

- Sales Tax Liability Report

- Customer Summary Report

- Bill Payments List

- Profit and Loss by Month

Matching Principle and Payroll Practice Quiz

6. A salesperson makes a 5% commission on every sale they make in the month of January, but their commission isn't paid until February. This means that if they sell $100 worth of products in January, the company will pay them $5 in February.

When will the commission be recorded on the books?

- January

- February

7. An employee earns a bonus of $10,000 in 2019 based on their performance in the workplace. The bonus isn't paid out to them until 2020.

When will the bonus be recorded on the income statement?

- 2019

- 2020

8. Let's say a full time hourly employee’s pay period ends on April 20th, but they didn’t get paid until May 3rd. This expense needs to be recorded in which month?

- April

- May

Payroll Practice Quiz

9. The following could be payroll deductions on an employee’s paystub, except:

- SUTA

- Health insurance

- FICA

- Garnishment

10. The following are reasons for running payroll reports, except:

- They help inform decision making and tracking

- You might need to issue a report on a specific employee if there is a dispute on hours paid

- You might be asked to update the business owner on the cost of payroll

- They produce financial statements that are helpful

11. The following are examples of employee-related items on a paystub, except:

- Pay Period

- Gross Pay

- FUTA

- Deductions

12. The following are items that should be included in a payroll policy, except:

- How employees will be paid

- Where payroll will be submitted

- What deductions and benefits will impact pay.

- When employees will be paid

Bookkeeping for Payroll Practice Quiz

13. An employee's paycheck will be: Gross Wages Earned - Deductions = Net pay. This will be the amount recorded for wages payable.

- True

- False

14. Which of the following is not true of a guaranteed payment to a partner in a partnership business?

- There are no withholdings from the payment.

- They are made regardless of how the business is doing.

- They are considered employee wages.

- They must be reasonably compensated.

15. Payroll reports are for internal use only.

- True

- False

Payroll, Obligations, and Loans Assessment

16. True or False: Net pay is the result of total wages earned minus SUTA (state unemployment tax).

- False

- True

17. All of the following are examples of employee deductions when calculating net pay except:

- FUTA

- FICA

- Health Insurance

- Garnishments

18. Jose is expanding his painting business and wants to hire additional contractors to help out. He knows these employees are not actually considered employees but are non-employees. As non-employees, Jose knows the following are true except:

- He will have to withhold FICA taxes and submit those with regular employee withholdings

- He will not have to pay overtime as time and a half, but will pay the regular rate regardless of hours

- He will use a form W-9 for hiring instead of a W4.

- He will expect an invoice from his contractors for hours worked and pay owed

19. Aruna is a partner in her sister Yasmine’s company, ‘Simply Saffron,’ a traditional Indian cuisine restaurant known for its open tandoor kitchen and Vindaloo. Aruna and Yasmine have decided to make sure they are equally invested and share the day-to-day running of the restaurant. They have also decided not to pay themselves by guaranteed payments, but will instead use a different option. Which of the following is the other option available to them as ownership partners?

- They can’t pay themselves as business owners unless the business makes profits.

- They can use an owner’s draw as needed, but cannot draw more than their initial investment until the end of the year profits are known.

- Pay themselves a salary, that way it’s a predictable amount and can be accounted for under employee wages.

- Pay themselves hourly wages instead, making sure they don’t have any overtime.

20. For Simply Saffron, food sales are subject to one sales tax rate, alcohol a different sales tax rate, and their branded merchandise a third sales tax rate. In addition to confirming rates and categories with their accountant, which QuickBooks Online tool can they use to accurately track their sales tax liability?

- Sales Tax Center

- Sales Tax Invoice

- Chart of Accounts

- Payroll Tax Center

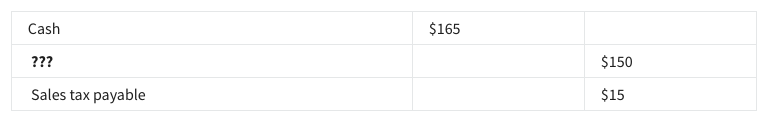

21. The computer system stopped working, and Aruna has to calculate sales tax manually. The food bill is $150, and it’s subject to a 10% tax. What’s the total amount she should charge the customer? (Use whole numbers and don't use a $ sign)

165

22. Which account should be credited $150 to complete this journal entry when recording a $165 sale that includes $15 sales tax?

- Sales tax receivable

- Expense

- Revenue

- Accounts payable

23. Money collected from a customer as sales tax should be booked as revenue.

- False

- True

24. All of the following factors can impact sales tax liability except:

- The type of software you use to track your tax

- The type of product or service you are selling

- If you have e-commerce sales

- Where your business is located

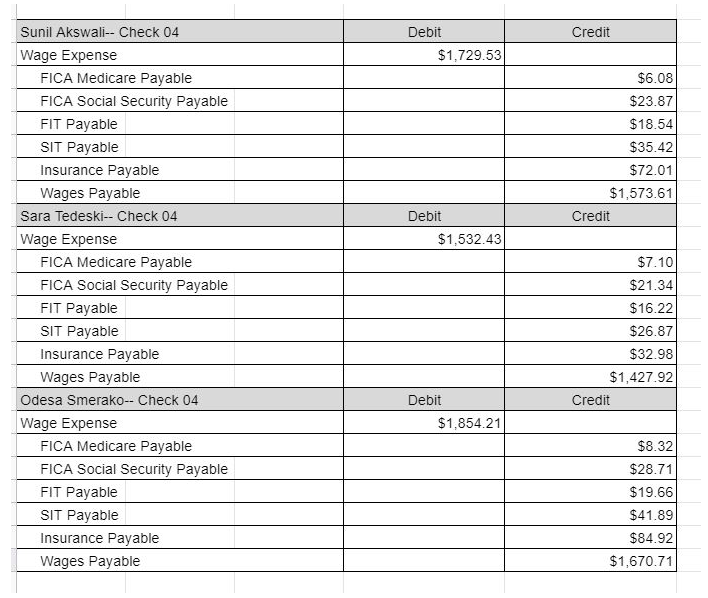

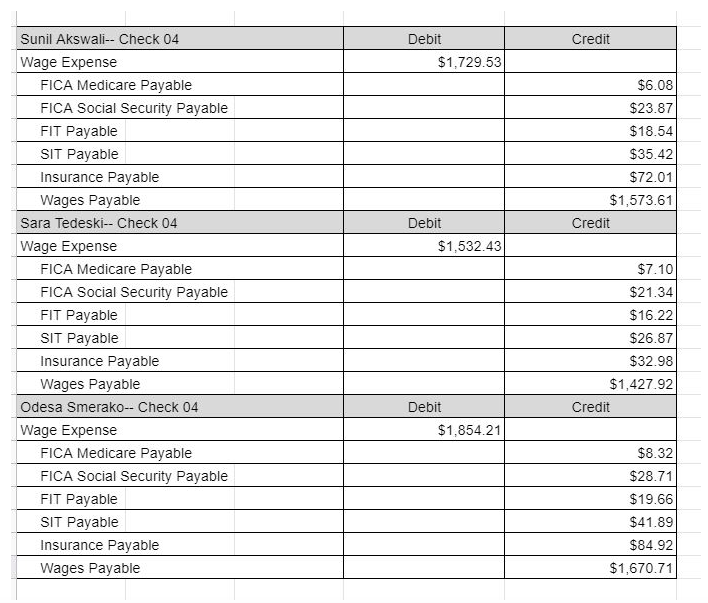

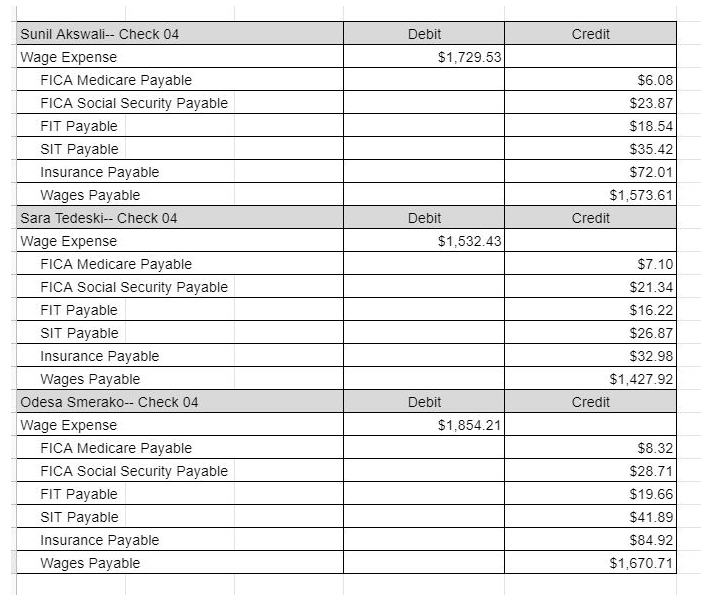

26. What are Sara Tedeski’s total current deductions? (format your answer as xxx.xx and don't use a $ sign)

27. What is Odesa Smerako’s gross pay? (format your answer as xxxx.xx and don't use a $ sign)

28. What would be the total wages debited on the journal for the wages and salaries expense account? (format your answer as xxxx.xx and don't use a $ sign)

5116.17

29. What would be the total employee amount credited under FICA Social Security Payable on the journal? (format your answer as xx.xx and don't use a $ sign)

73.92

30. The end of the year holiday season is upon us and Carter is so excited about the anticipated boom of his business, “Candy Cane Lanes”, a holiday-themed pop-up bowling alley. Carter has already hired seasonal help. He has several events already lined up at the end of November leading into their busiest month. He’s set up his first pay period to run from Monday, November 23rd - Sunday, Dec. 6th with hourly employees paid bi-weekly by direct deposit. This means, their first paycheck won’t be deposited until Wednesday, December 9th. When would Carter record the wage expense for this pay period in his books?

- On December 6th, when the pay period ends.

- He would have to calculate how much of the wages were earned in November to record at the end of the month and do a similar calculation for December’s wages.

- He would wait until December 9th to record the wages earned.

- On December 7th, the day after the pay period ends.

31. Only a tax accountant can provide tax advice, but as a bookkeeper, you can guide employees when filling out their tax income forms.

- True

- False

32. Your business address and services will factor into your tax frequency, tax agency, and tax rate.

- True

- False

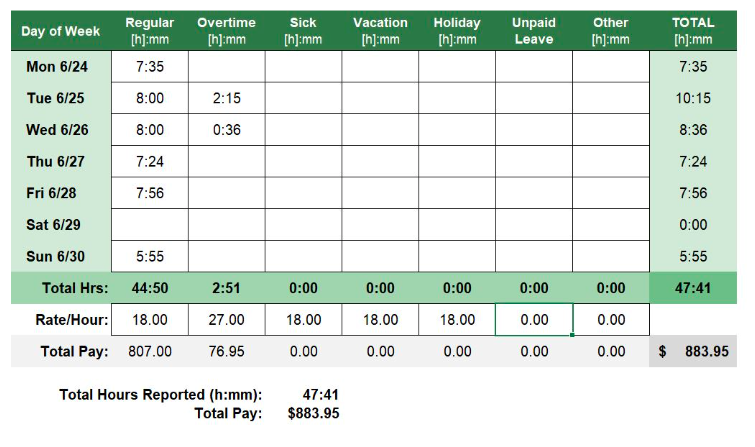

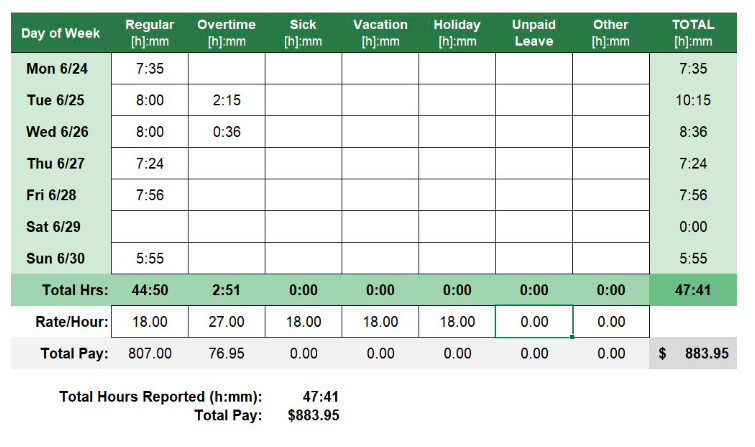

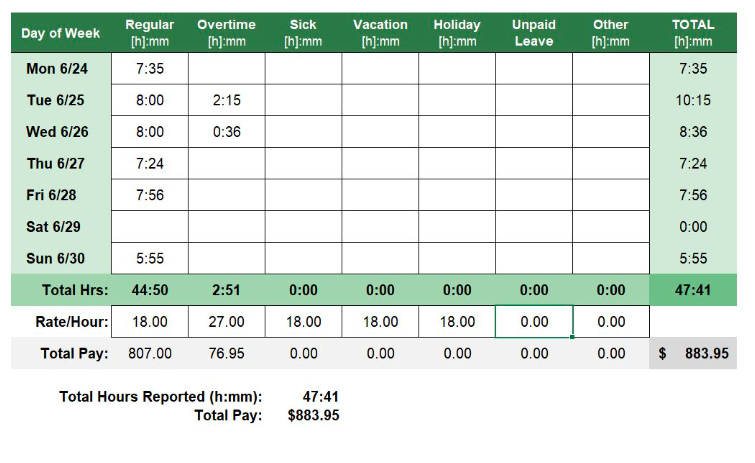

34. If this employee had deductions totaling $112.46 for this weekly period, what would be their net pay? (format your answer as xxx.xx and don't use a $ sign)

35. If this employee was classified as exempt under FLSA (Fair Labor Standards Act), what would be different about this time card? Select all that apply.

- They would be paid a flat weekly rate.

- They would not have any overtime pay.

- They would have been paid overtime on Sunday, because they worked the weekend.