financial statement analysis coursera week 1 quiz answers

Reconciliation Types and Processes Practice Quiz

1. If your account balances don’t match at the end of the month, which of the following steps should you take to find the error? Select all that apply.

- Check the balance difference and cross-reference for missing transactions of that amount

- Check for transposition errors (number amounts being flip flopped)

- Don’t worry about it. Books have a way of balancing out over time

- Go line by line comparing ledger entries with the external account statement

2. If I use the balance sheet approach for reconciling the books each month, all of the following accounts would be reconciled except:

- Accounts Payable

- Cash

- Inventory

- Bank Statement

3. The reconciliation process can help with the following except:

- Ensure account balances are accurate

- Ensuring the business is profitable

- Ensuring all transactions are accounted for

- Ensure any fraudulent activities are more easily detected

4. True or False: The month-end close-out process for certain accounts is considered a type of reconciliation.

- False

- True

Reconciliation Source Documentation Types Practice Quiz

5. The original records that prove a specific transaction took place are referred to as:

- Original records

- Source Records

- Original Documents

- Source Documents

6. Which of the following is considered a source document?

- Receipt

- Bank Statement

- Invoices

- All the above

7. Which of the following is not considered an element of a source document?

- Reference Number

- Company Logo

- Date of the Transaction

- Description of the Transaction

Report Reconciliations vs Transactional Reconciliations Practice Quiz

8. Which of the following best describes the Transactional Method of Reconciliation?

- The method of comparing the amount listed on a source document to the actual ending balance listed on the balance sheet

- The method of reviewing existing transactions and source documents to confirm the amount was spent

- The method of determining the amount that can be written off for an asset over time

- The method of using credits and debits to record transactions

9. Which of the following best describes the Report Method of Reconciliation?

- The method of determining the equity that an owner or shareholder currently has within the company

- The method of comparing the amount listed on a source document to the actual ending balance listed on the balance sheet

- The method of reviewing existing transactions and source documents to confirm the amount was spent

- The method of determining if the books are balanced by using the equation Assets = Liabilities + Equity

10. Which of the following accounts can be reconciled using the report reconciliation method? (select all that apply)

- Payroll

- Long Term Note

- Accounts Payable

- Cash Account

Understanding Reconciliations Assessment

11. True or False: Reconciliation is the process by which a business verifies its books with external account statements or data to ensure they match and reflect accurate business dealings.

- True

- False

12. Stan is in the process of performing a month-end close-out for his business, Lock ‘n Key. He noticed that his cash account indicates a difference of $25 from his bank statement. The following are strategies he can use to reconcile his books, except:

- Check for any service fees the bank may have charged

- Check for any uncleared checks

- Stan can withdraw $25 from his bank, and that will balance out his books

- Perform a line-by-line review of transactions in his general ledger with the bank statement

13. The following are examples of source documents except:

- Post-it Note

- Bank Statements

- Credit Memos

- Invoices

14. The following are pros of using the Report Review Method for Reconciliation, except:

- It can highlight problem accounts to focus on

- It provides a detailed level review

- It can be a faster process than other methods

- It can give insight into the business health and trends for certain accounts

15. Which of the following accounts can be reconciled using the report reconciliation method? (Select all that apply)

- Cash Account

- Long Term Note

- Payroll

- Accounts Payable

16. True or False: As long as the items are legible and contain all of the original information, in most cases, a photocopy or digital copy of a source document is deemed acceptable.

- False

- True

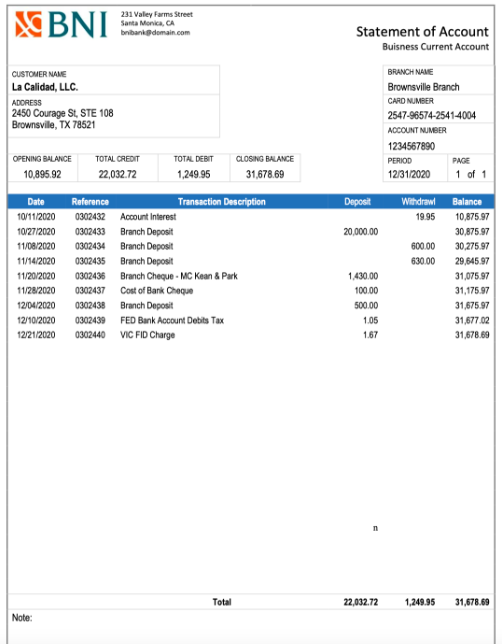

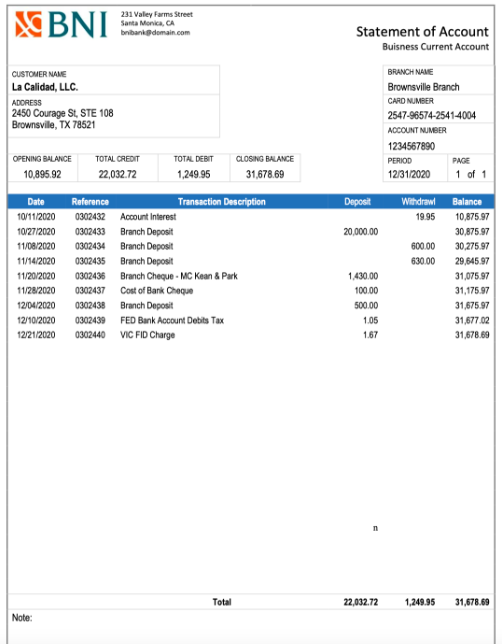

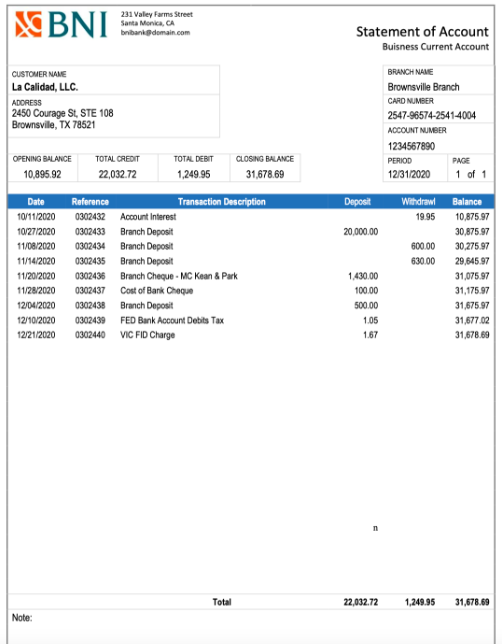

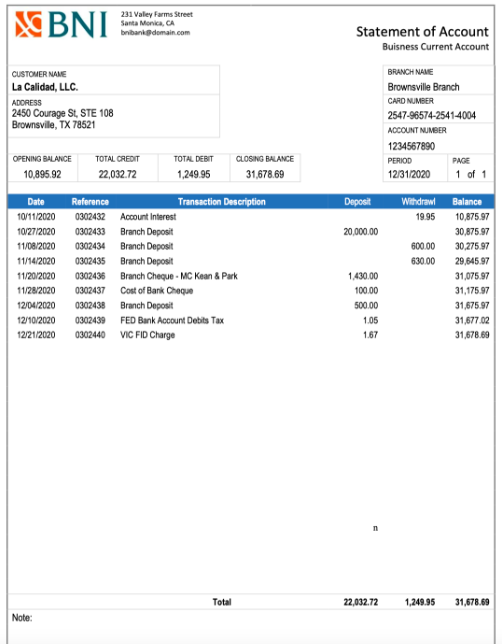

17. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of her accounts and is about to do her final quarterly review. She begins with an analytical review, and then, digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

Compare the two documents below to reconcile the bank account. Then, determine which of the following are errors. (Select all that apply)

- The ledger omitted the bank tax on 12/10

- The charge on 12/21 was transposed incorrectly

- The balance totaled on 10/27 and 11/01 is incorrect

- The bank omitted the check deposit on 11/14

18. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

What additional source documents might Zapata need to complete this bank reconciliation? (Select all that apply)

- Credit card statement

- Checkbook ledger

- Bank fees schedule or policy

- Report of checks written but not yet cleared

19. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

Which type of error occurred for the entry on 12/21/20?

- Transpositional

- Omission

- Addition

- Reversal

20. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

What might be a strategy Zapata could use to prevent this from occurring again in the future? (Select all that apply)

- Make sure she is closing out and reconciling all her accounts each month

- Use estimates to close out her books each month, then perform an annual transactional account reconciliation at the end of the year

- Use a software tool, like QuickBooks Online, to minimize human errors

- Perform a balance sheet approach reconciliation each month

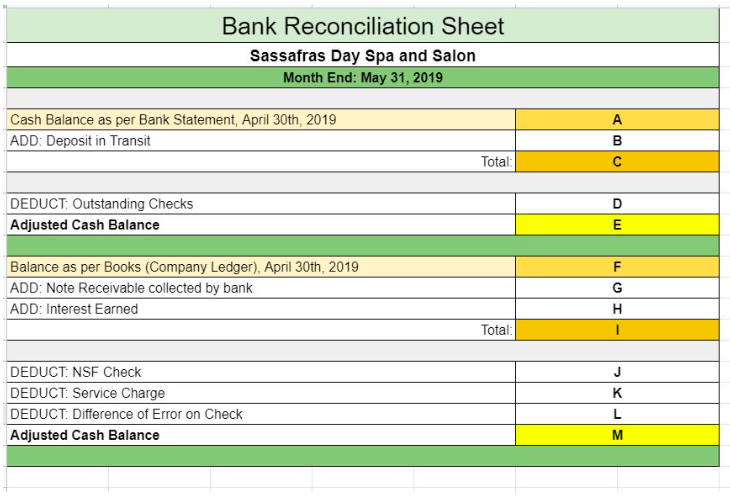

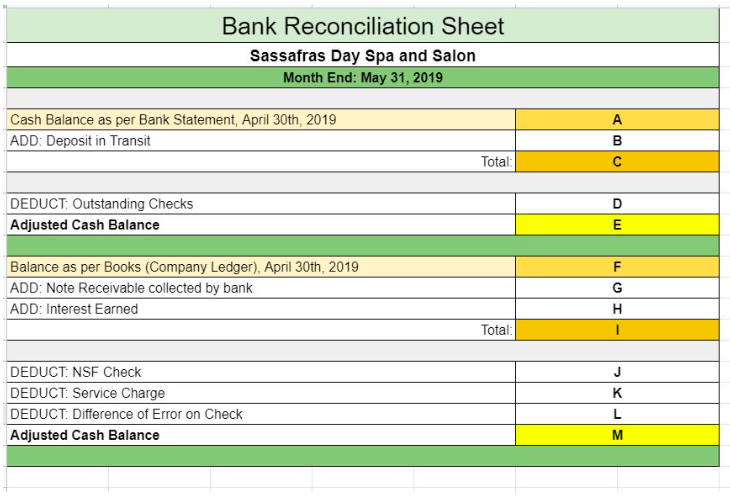

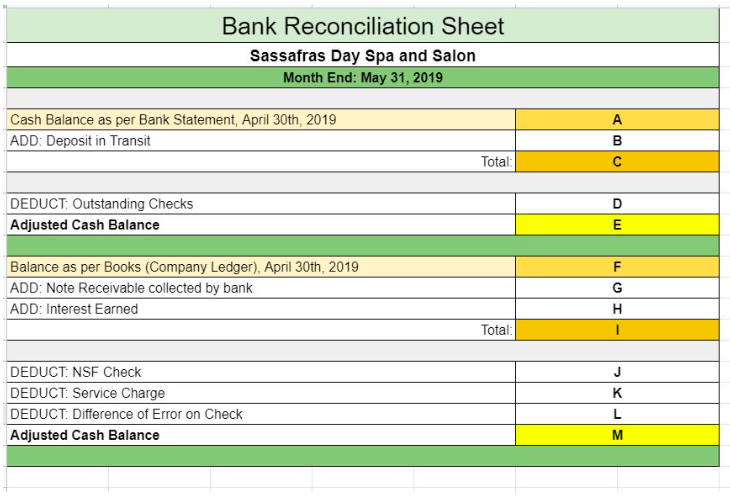

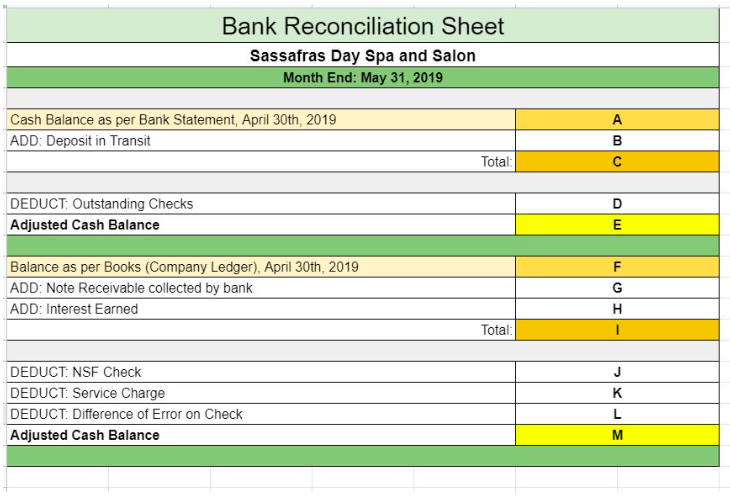

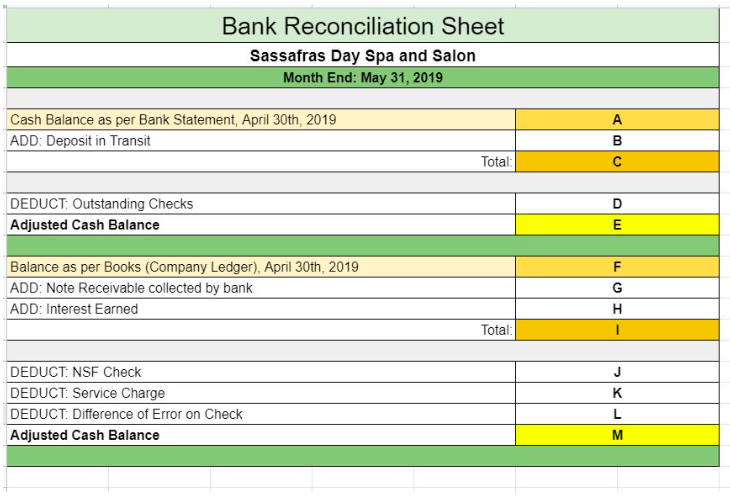

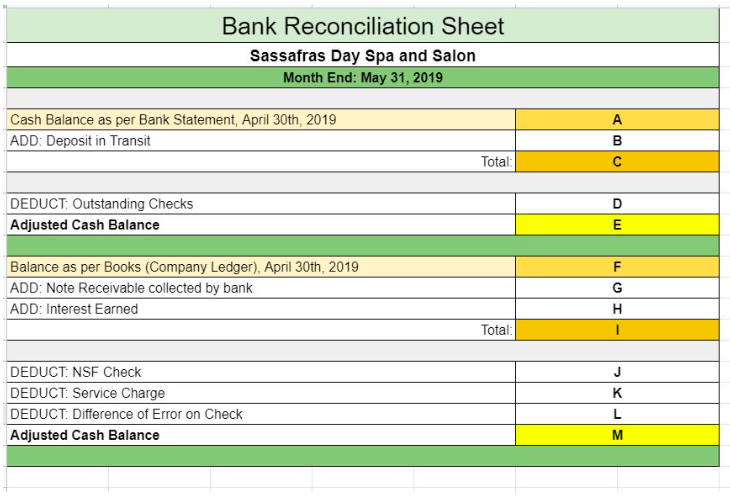

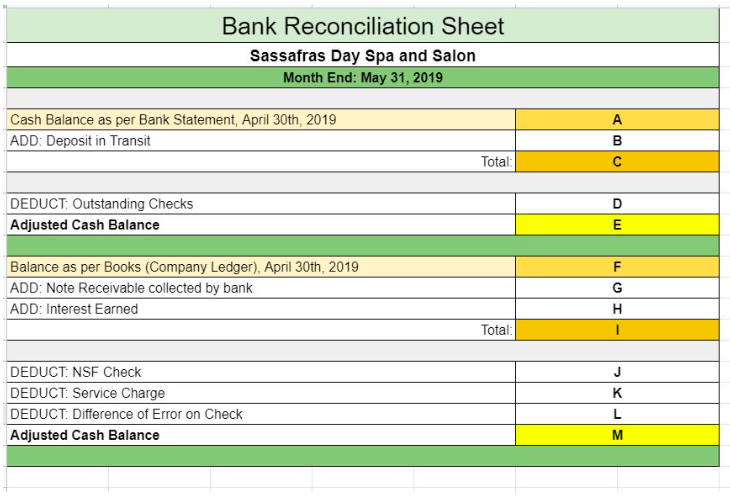

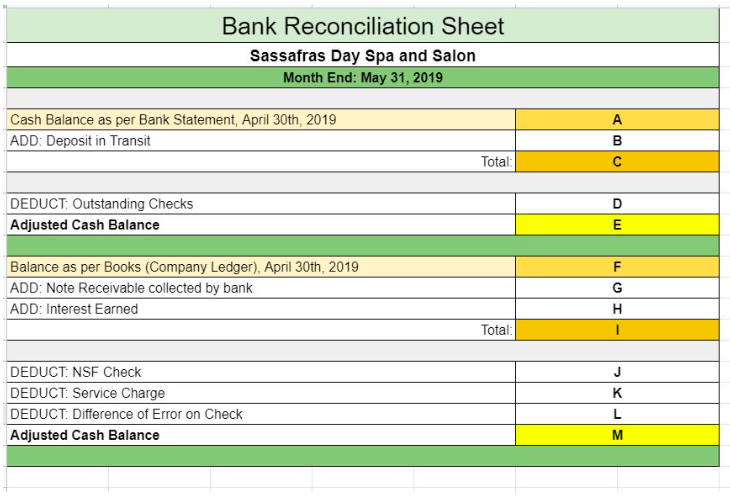

21. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the amount that should be put in space J? (format your answer as xxxxxx-no decimals, commas, or $ signs)

22. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the difference being reconciled between the ending balance of the bank statement and the ending balance recorded on the books for April 30th, 2019? (format your answer as xxxxxx-no decimals, commas, or $ signs)

39100

23. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the amount that should be listed on line L? (format your answer as xxxxxx-no decimals, commas, or $ signs)

24. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What amount goes on line B? (format your answer as xxxxxx-no decimals, commas, or $ signs)

25. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

Which of the following amounts is the correct amount for Line I?

- $270,720

- $320,900

- $260,900

- $320,000

26. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

Which of the following amounts is the correct amount for line D?

- $100

- $50,000

- $20,000

- $9,800

27. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the total amount of deductions taken on the balance per the books portion of the reconciliation? (format your answer as xxxxxx-no decimals, commas, or $ signs)

720

28. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the correct adjusted cash balance amount that should be listed on lines E and M to reconcile this account?

- $310,200

- $270,720

- $250,000

- $270,000

29. Which of the following best describes the Transactional Method of Reconciliation?

- The method of determining the amount that can be written off for an asset over time.

- The method of comparing the amount listed in the source document to the actual ending balance listed on the balance sheet.

- The method of reviewing existing transactions and source documents to confirm the amount was spent.

- The method of comparing percent changes in data period over period.

30. Which of the following best describes the Report Method of Reconciliation?

- The method of writing a bank statement reconciliation to complete an end of month close on the cash account.

- The method of comparing the amount listed in the source document to the actual ending balance listed on the balance sheet.

- The method of using the equation A=L+E to determine if the books are balanced.

- The method of reviewing source documents to prepare for tax returns.