bookkeeping basics coursera week 1 answers

Welcome Practice Quiz

1. As a bookkeeper, you will be primarily concerned with a business’s:

- Technology Investments

- Financial Transactions

- Employee Benefits

- Marketing Strategy

Role of a Bookkeeper Practice Quiz

2. Which of the following is not a typical task bookkeepers perform for their clients?

- Handle all accounts payable and receivable.

- Prepare financial statements.

- Complete tax requirements.

- Reconcile bank accounts.

3. Which of the following is an ethical/social responsibility associated with Objectivity?

- Never using inside information regarding the client for personal gain.

- Maintaining your credentials and continuing education.

- Reporting financial data accurately and timely.

- Never letting any personal bias get in the way of performing your duties.

4. Which of the following is an ethical/social responsibility associated with Honesty?

- Never allowing another party to influence your findings.

- Never discussing anything related to the client outside of the job.

- Owning any mistakes and doing everything you can to fix them.

- Avoiding any activity, both in your personal or professional life, that could bring shame to the profession and client.

Accounting Equation Practice Quiz

5. The accounting equation can be written as _______ = Liabilities + Equity.

- Assets

6. Which of these would be considered an asset?

- A vehicle

- The owner’s investment in the company.

- Mortgage

7. If Lou opened a line of credit at the tractor supply store and used it to purchase $600 in inventory, how would you categorize the $600 borrowed from the store?

- Asset

- Equity

- Liability

8. If Lou's purchase increased liabilities by $600, what would also need to happen for the accounting equation to be in balance?

- Add $600 to assets

- Subtract $600 from assets

- Add $600 to equity

Double-Entry Accounting Practice Quiz

9. Lou received a $100 payment for a weeding job he completed for Ms. Rosa. How would you record this transaction?

- $100 Debit Cash; $100 Credit Lawncare Revenue

- $100 Debit Lawncare Revenue; $50 Credit Cash; $50 Credit Ms. Rosa’s Account

- $100 Credit Cash; $100 Debit Ms. Rosa’s account

- $100 Credit Cash; $100 Debit Lawncare Revenue

10. Lou was paid $280 by Eagles Landing subdivision.

How would you record this transaction?

- Debit Lawncare Revenue $280; Credit Cash $280.

- Credit Lawncare Revenue $280; Debit Accounts Receivable

- Debit Cash $280; Credit Lawncare Revenue $280

- Credit Cash $280; Debit Accounts Receivable $280

11. Lou purchased his truck for $32,000. He paid $2,000 cash and took out a $30,000, 5-year loan.

Select the correct journal entry below.

12. The general journal is used to record transactions in chronological order.

Each transaction requires two entries, a credit and a _____.

- debit

13. When creating a journal entry, the following are true.

Select all true statements.

- You can only include two accounts.

- You record credits on the right.

- The credit and debit totals must be equal.

- You record debits on the left.

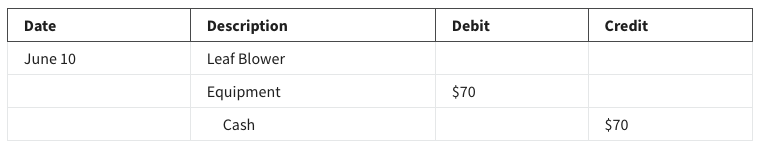

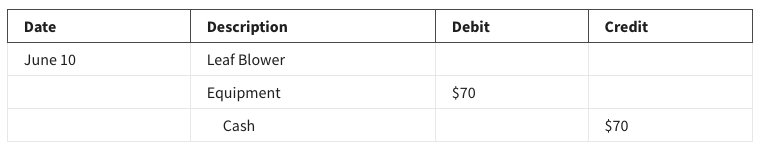

14. In this example, the journal entry shows a(n) _______ in the Equipment account and a(n) ______ in the Cash account.

- increase, increase

- increase, decrease

- decrease, decrease

- decrease, increase

15. This journal entry could represent:

- Purchasing $70 worth of equipment with cash.

- Selling $70 worth of equipment for cash.

- Purchasing $70 worth of equipment on credit.

- Selling $70 worth of equipment on credit.

Accounting Concepts and Measurement Assessment

16. What tasks would a bookkeeper do?

- Manage accounts receivable/payable, recording financial transactions, and implement HR policies

- Record financial transactions, create employee write-ups, and handle bank feeds and reconcile bank accounts

- Handle bank feeds and reconciles bank accounts, managing accounts receivable/payable, and record financial transactions

17. Mary Smith is the owner and operator of Smith Construction. At the end of the company's accounting period, December 31, 2020, Smith

Construction has assets totaling $760,000 and liabilities totaling $240,000.

Use the accounting equation to calculate what Mary’s Owner Equity would be as of December 31, 2020.

(Enter your answer as a whole number. Don't use a decimal, for example $xxx,xxx)

- $520,000

18. Mike Anderson is the owner and operator of Anderson Consulting. At the end of 2019, the company’s assets totaled $500,000 and its liabilities totaled $175,000. Assuming that over the 2020 fiscal year, assets increased by $120,000 and liabilities increased by $72,000, use the accounting equation to determine what Mike’s Owner's equity will be as of December 31, 2020?

(Enter your answer as a whole number. Don't use a decimal.)

- $373,000

19. Maria Garcia owns a software consulting firm. At the beginning of 2019, her firm had assets of $800,000 and liabilities of $185,000. Assuming that assets decreased by $52,000 and liabilities increased by $24,000 during 2020, use the accounting equation to calculate equity at the end of 2020.

(Enter your answer as a whole number. Don't use a decimal, for example $xxx,xxx)

- $539,000

20. The accounting equation can be defined as:

- Assets = Liability / Equity

- Revenue – Expenses = Income

- Assets = Liability + Equity

21. What the company owns or controls and expects to gain value from is defined as:

- Equity

- A Liability

- An Asset

22. What the company owes to others is defined as:

- Liabilities

- Assets

- Equity

23. The owner’s stake in the company is defined as:

- Liabilities

- Assets

- Equity

24. A way of bookkeeping that tracks which accounts increase and which decrease for a given transaction is known as:

- Multiple-entry

- Double-entry

- Single-entry

25. Which of the following best defines a credit as it’s used in double-entry accounting?

- A decrease in assets/expenses and an increase in liabilities/owner’s equity and revenue.

- An increase in liabilities/expenses and a decrease in assets/owner’s equity and revenue.

- An increase in assets/owner’s equity and income and a decrease in liabilities/expenses.

- An increase in assets/expenses and a decrease in liabilities/owner’s equity and revenue.

26. Which of the following best defines a debit as it’s used in double-entry accounting?

- An increase in assets/expenses and a decrease in liabilities/owner’s equity and revenue.

- An increase in liabilities/expenses and a decrease in assets/owner’s equity and revenue.

- A decrease in assets/expenses and an increase in liabilities/owner’s equity and revenue.

- An increase in assets/owner’s equity and income and a decrease in liabilities/expenses.

27. You purchased inventory from your vendor and paid cash. The accounts affected are the inventory account and the cash account. In your journal entry, which account would you debit?

- Inventory account

- Cash account

28. An owner invests $1000 in the company. This transaction impacted the checking account and the owner’s equity account. In your journal entry, which account do you credit?

- Checking account

- Owner’s equity account

29. A sales manager purchases office supplies with the company credit card. This transaction impacts the accounts payable and the office supplies accounts. In your journal entry, which account do you credit?

- Office supplies account

- Accounts payable

30. The company pays off the credit card bill. This transaction impacts the accounts payable and the cash accounts. In your journal entry, which account do you credit?

- Cash account

- Accounts payable

31. Debits are always represented on what side of a T-chart?

- The left.

- The right.

32. Short-term Investments would be an example of what kind of account?

- An asset account.

- A liability account.

33. Accounts payable would be an example of what kind of account?

- An asset account.

- A liability account.

34. Accounts receivable would be an example of what kind of account?

- A liablity account.

- An asset account.

35. True or False: Your client was paid in cash for a service that they provided. They’ve asked you to leave it off their financial records. Since you are employed by the client, you should do what they ask.

- True

- False