21. When you record a sales receipt or invoice for $500, the accounting software will automatically credit the relevant __________ by $500.

- Revenue account

- Expense account

- Liability account

- None of these

Promissory Notes Practice Quiz

22. In bookkeeping, a signed agreement between two parties, used to document money owed, interest, and payment timeframe is known as what?

- Bad Debt

- Notes Receivable

- General Ledger

- Promissory Note

23. True or False. The Direct Write-Off method of accounting for “Bad Debt” adheres to the matching principle.

- True

- False

24. Notes Receivable is money that is owed to that company and is therefore classified as ______?

- Asset

- Liability

- Equity

Accounting Concepts and Measurement Assessment

25. True or False. An accumulated depreciation account is considered an account with a natural credit balance, meaning the account increases with debits and decreases with credits.

- True

- False

26. Suzie Santo owns “Chiquita Chihuahua”, a boutique pet supplies store with customized canine offerings. She has a vendor, “Paws Free”, that supplies her with high-end carrying cases for small dogs. Suzie ordered $8000 worth of cases for the upcoming travel season on credit, but didn’t plan on a pandemic shutting down all travel and not to mention her business for 6 months. She contacts Ricky at “Paws Free'' to work out an arrangement to settle her account. What type of document is used for this type of agreement?

- Trial Balance

- Notes Payable

- Notes Receivable

- Promissory note

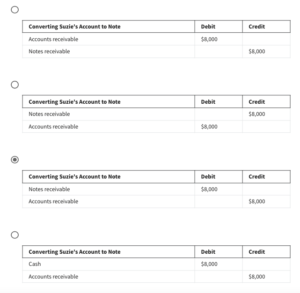

27. Suzie agrees to pay Ricky the $8,000 in 2 months, at 15% interest. Which of the following is the most accurate way Ricky and Suzie should record this event on each of their balance sheets?

- Ricky will record $9,200 as a Notes Receivable, Suzie will record $9,200 as a Notes Payable.

- Ricky will add $8,000 as a Notes Payable and Suzie will add $8,000 as a Notes Receivable.

- Ricky will add $9,200 as a Cash deposit, and Suzie will record $9,200 as a Notes Payable.

- Ricky will record the balance as a Notes Receivable and Suzie will list the $8,000 as a Notes Payable.

28. Continuing with our example, would Ricky’s notation on the balance sheet fall under the asset or liabilities column?

- Liability

- Asset

Shuffle Q/A 3

29. Would Suzie record this transaction as an asset or a liability on her balance sheet?

- Asset

- Liability