31. Only a tax accountant can provide tax advice, but as a bookkeeper, you can guide employees when filling out their tax income forms.

- True

- False

32. Your business address and services will factor into your tax frequency, tax agency, and tax rate.

- True

- False

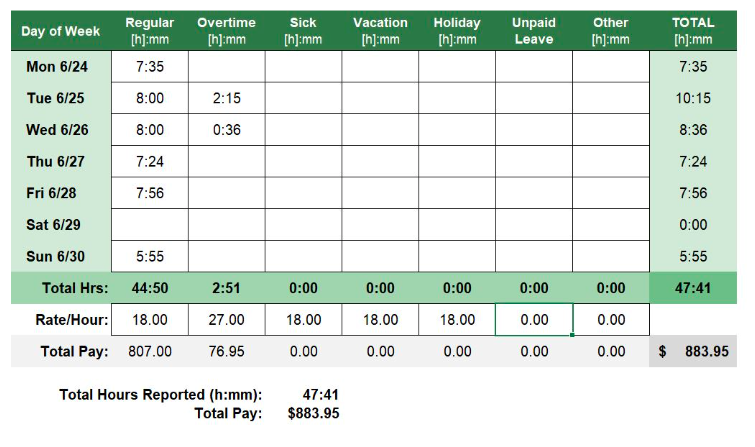

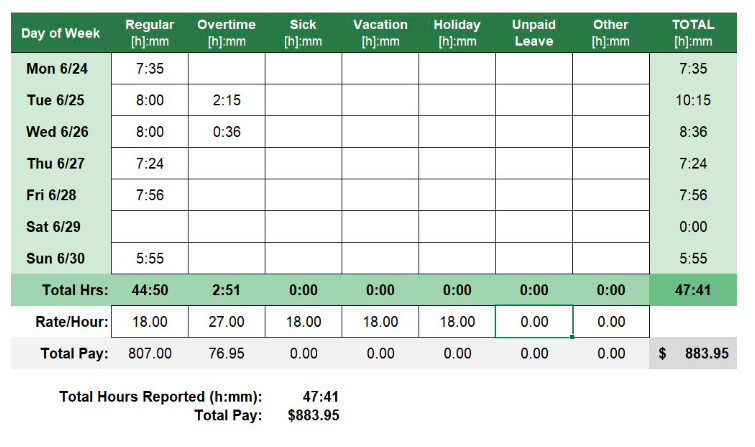

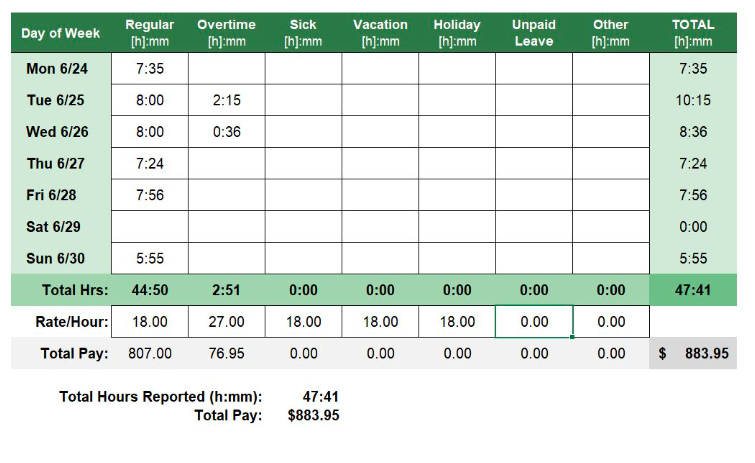

34. If this employee had deductions totaling $112.46 for this weekly period, what would be their net pay? (format your answer as xxx.xx and don't use a $ sign)

35. If this employee was classified as exempt under FLSA (Fair Labor Standards Act), what would be different about this time card? Select all that apply.

- They would be paid a flat weekly rate.

- They would not have any overtime pay.

- They would have been paid overtime on Sunday, because they worked the weekend.