21. The computer system stopped working, and Aruna has to calculate sales tax manually. The food bill is $150, and it’s subject to a 10% tax. What’s the total amount she should charge the customer? (Use whole numbers and don't use a $ sign)

165

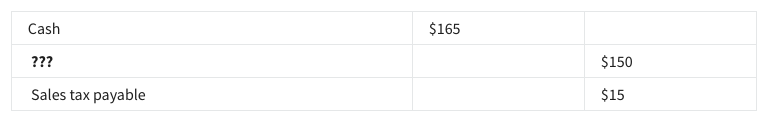

22. Which account should be credited $150 to complete this journal entry when recording a $165 sale that includes $15 sales tax?

- Sales tax receivable

- Expense

- Revenue

- Accounts payable

24. All of the following factors can impact sales tax liability except:

- The type of software you use to track your tax

- The type of product or service you are selling

- If you have e-commerce sales

- Where your business is located

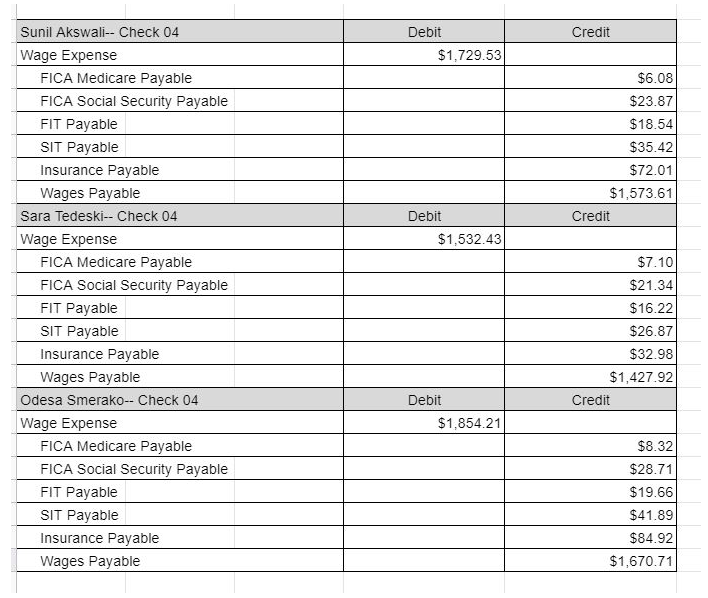

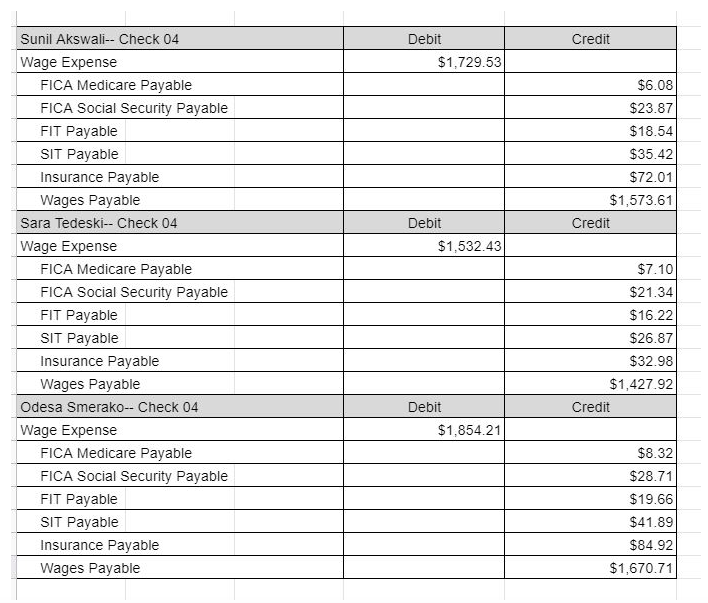

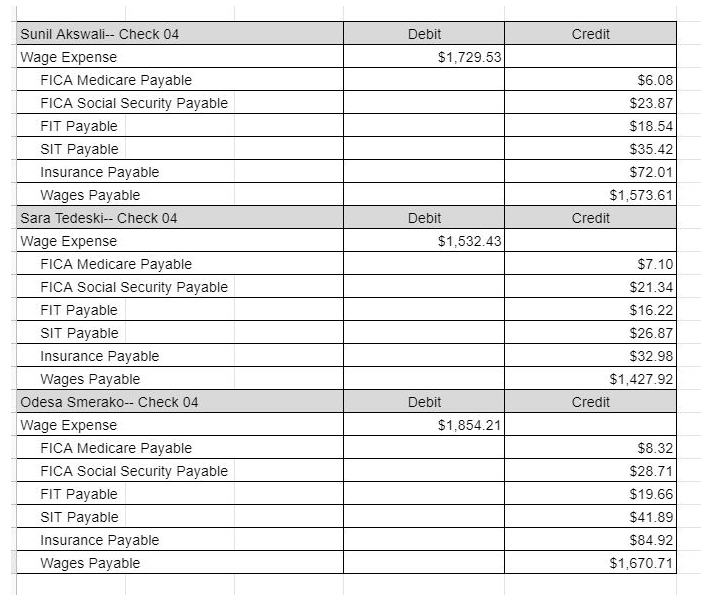

26. What are Sara Tedeski’s total current deductions? (format your answer as xxx.xx and don't use a $ sign)

27. What is Odesa Smerako’s gross pay? (format your answer as xxxx.xx and don't use a $ sign)

28. What would be the total wages debited on the journal for the wages and salaries expense account? (format your answer as xxxx.xx and don't use a $ sign)

5116.17

Shuffle Q/A 3

29. What would be the total employee amount credited under FICA Social Security Payable on the journal? (format your answer as xx.xx and don't use a $ sign)

73.92

30. The end of the year holiday season is upon us and Carter is so excited about the anticipated boom of his business, “Candy Cane Lanes”, a holiday-themed pop-up bowling alley. Carter has already hired seasonal help. He has several events already lined up at the end of November leading into their busiest month. He’s set up his first pay period to run from Monday, November 23rd - Sunday, Dec. 6th with hourly employees paid bi-weekly by direct deposit. This means, their first paycheck won’t be deposited until Wednesday, December 9th. When would Carter record the wage expense for this pay period in his books?

- On December 6th, when the pay period ends.

- He would have to calculate how much of the wages were earned in November to record at the end of the month and do a similar calculation for December’s wages.

- He would wait until December 9th to record the wages earned.

- On December 7th, the day after the pay period ends.