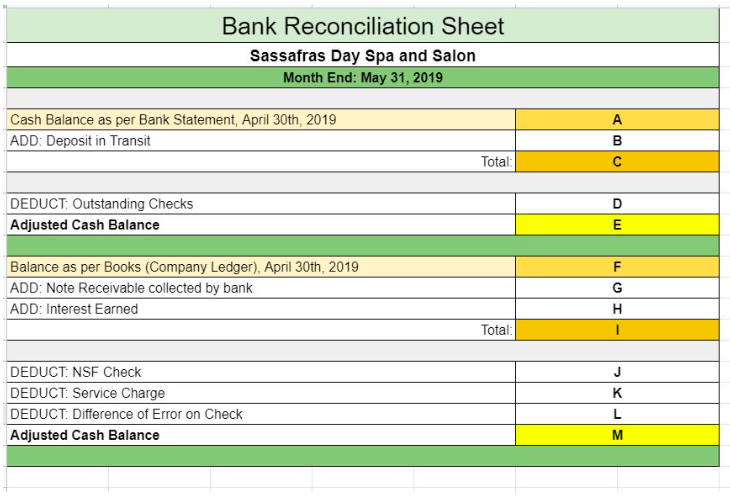

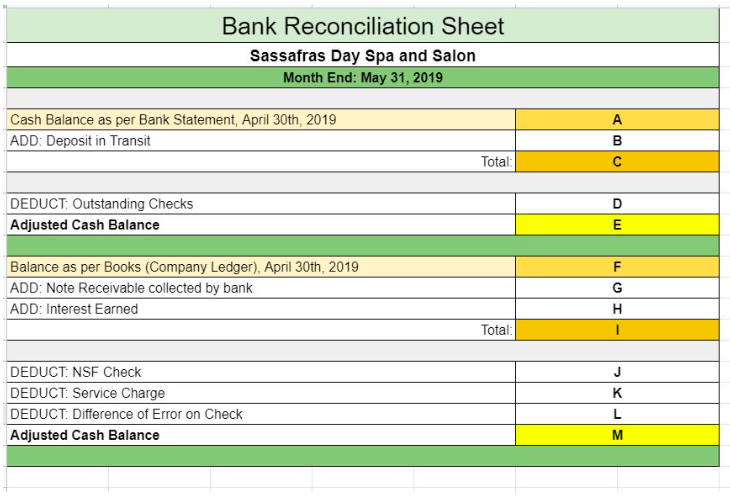

21. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the amount that should be put in space J? (format your answer as xxxxxx-no decimals, commas, or $ signs)

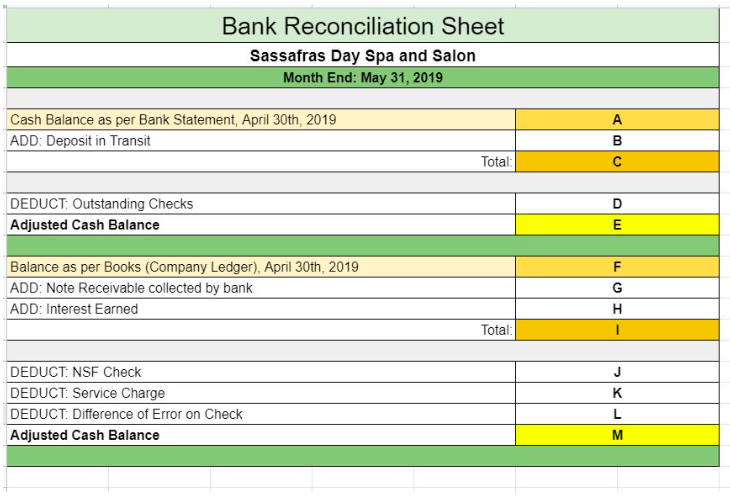

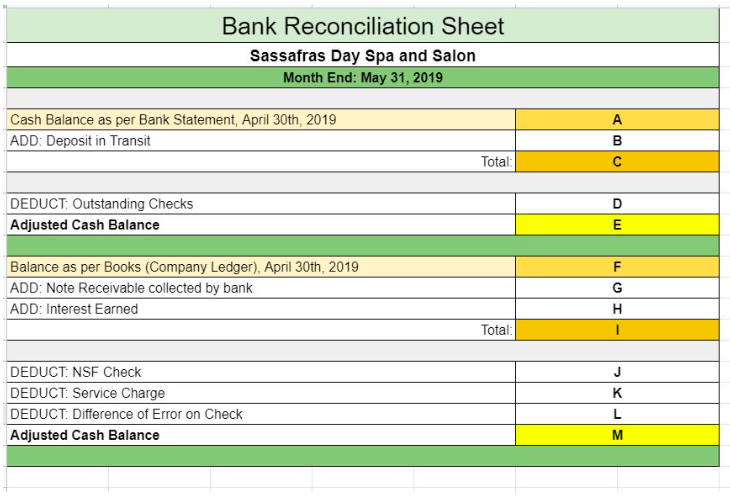

22. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the difference being reconciled between the ending balance of the bank statement and the ending balance recorded on the books for April 30th, 2019? (format your answer as xxxxxx-no decimals, commas, or $ signs)

39100

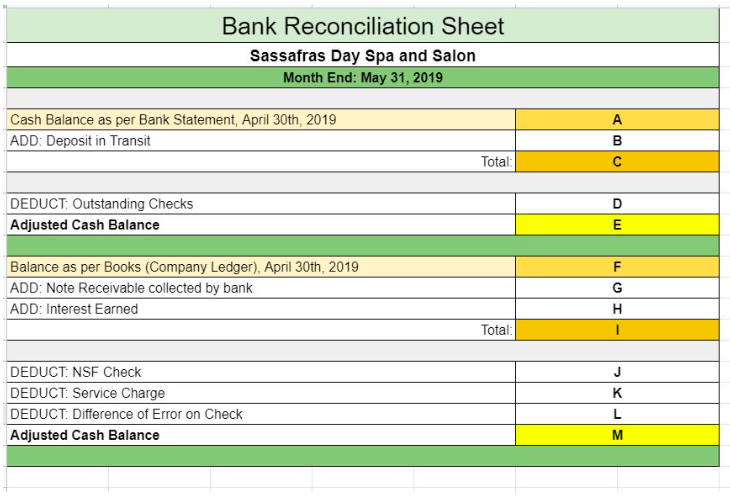

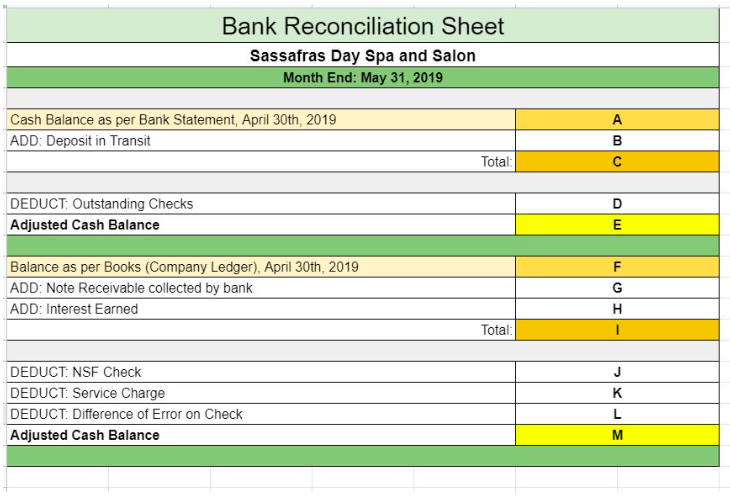

23. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the amount that should be listed on line L? (format your answer as xxxxxx-no decimals, commas, or $ signs)

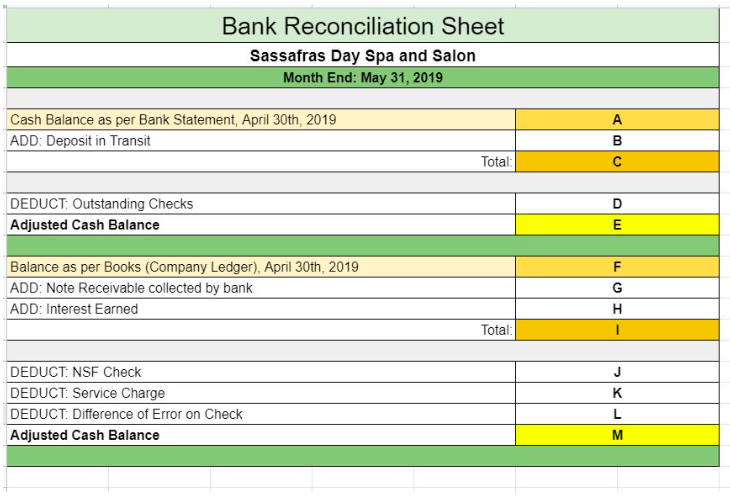

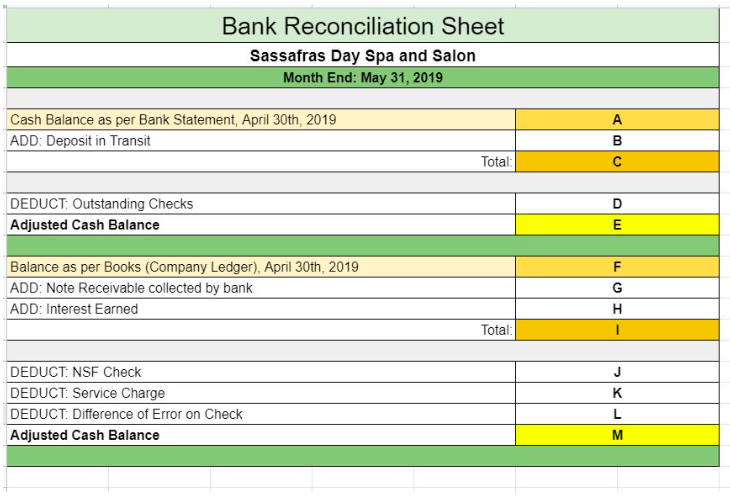

24. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What amount goes on line B? (format your answer as xxxxxx-no decimals, commas, or $ signs)

25. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

Which of the following amounts is the correct amount for Line I?

- $270,720

- $320,900

- $260,900

- $320,000

26. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

Which of the following amounts is the correct amount for line D?

- $100

- $50,000

- $20,000

- $9,800

27. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the total amount of deductions taken on the balance per the books portion of the reconciliation? (format your answer as xxxxxx-no decimals, commas, or $ signs)

720

28. Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

Bank statement contains an ending balance of $300,000 as of April 30th, 2019, whereas because some items were missing the balance on the books is $260,900.

Bank statement contains a $100 service charge for operating the account

Bank statement contains an interest income of $20

Sassafras Day Spa issued Checks of $50,000 that have not yet been cleared by the bank

Sassafras Day Spa deposited $20,000, but this did not appear on the bank statement

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370

A note receivable of $9800 was collected by the bank

A check of $520 deposited by Sassafras has been charged back as NSF

What is the correct adjusted cash balance amount that should be listed on lines E and M to reconcile this account?

- $310,200

- $270,720

- $250,000

- $270,000

29. Which of the following best describes the Transactional Method of Reconciliation?

- The method of determining the amount that can be written off for an asset over time.

- The method of comparing the amount listed in the source document to the actual ending balance listed on the balance sheet.

- The method of reviewing existing transactions and source documents to confirm the amount was spent.

- The method of comparing percent changes in data period over period.

30. Which of the following best describes the Report Method of Reconciliation?

- The method of writing a bank statement reconciliation to complete an end of month close on the cash account.

- The method of comparing the amount listed in the source document to the actual ending balance listed on the balance sheet.

- The method of using the equation A=L+E to determine if the books are balanced.

- The method of reviewing source documents to prepare for tax returns.