Understanding Reconciliations Assessment

11. True or False: Reconciliation is the process by which a business verifies its books with external account statements or data to ensure they match and reflect accurate business dealings.

- True

- False

12. Stan is in the process of performing a month-end close-out for his business, Lock ‘n Key. He noticed that his cash account indicates a difference of $25 from his bank statement. The following are strategies he can use to reconcile his books, except:

- Check for any service fees the bank may have charged

- Check for any uncleared checks

- Stan can withdraw $25 from his bank, and that will balance out his books

- Perform a line-by-line review of transactions in his general ledger with the bank statement

13. The following are examples of source documents except:

- Post-it Note

- Bank Statements

- Credit Memos

- Invoices

14. The following are pros of using the Report Review Method for Reconciliation, except:

- It can highlight problem accounts to focus on

- It provides a detailed level review

- It can be a faster process than other methods

- It can give insight into the business health and trends for certain accounts

15. Which of the following accounts can be reconciled using the report reconciliation method? (Select all that apply)

- Cash Account

- Long Term Note

- Payroll

- Accounts Payable

16. True or False: As long as the items are legible and contain all of the original information, in most cases, a photocopy or digital copy of a source document is deemed acceptable.

- False

- True

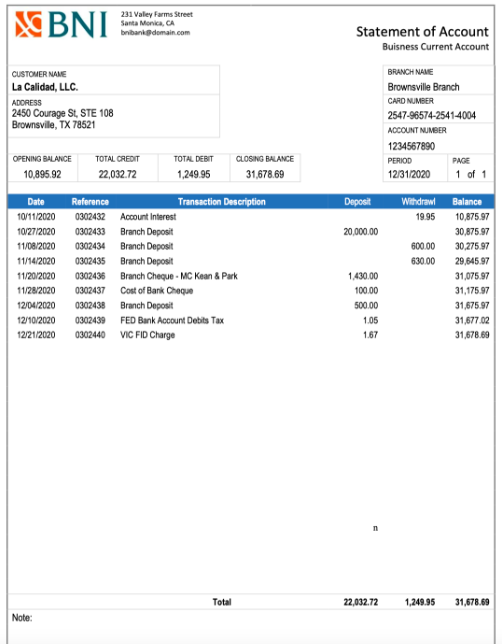

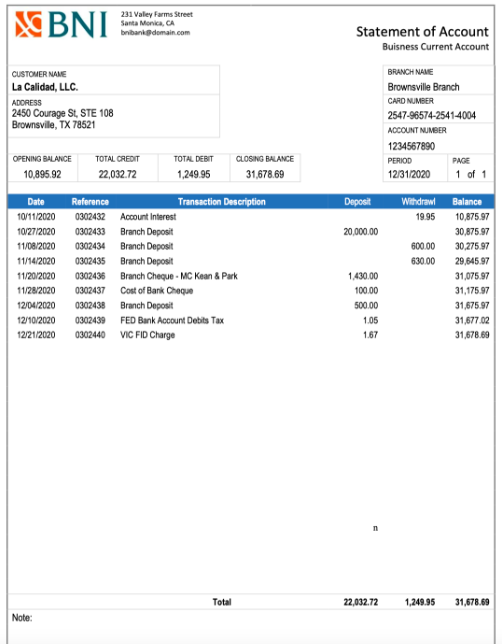

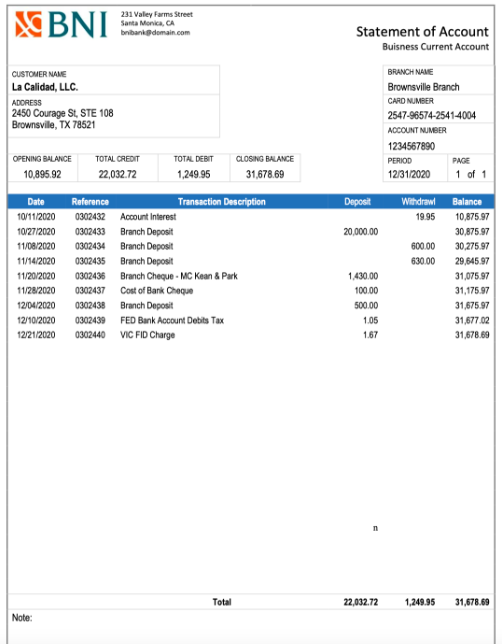

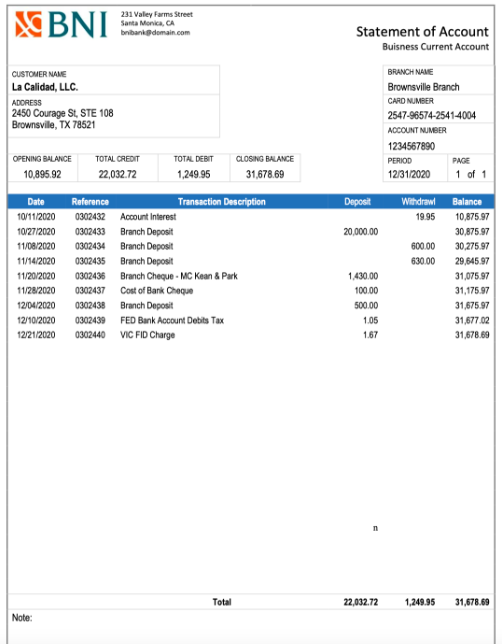

17. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of her accounts and is about to do her final quarterly review. She begins with an analytical review, and then, digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

Compare the two documents below to reconcile the bank account. Then, determine which of the following are errors. (Select all that apply)

- The ledger omitted the bank tax on 12/10

- The charge on 12/21 was transposed incorrectly

- The balance totaled on 10/27 and 11/01 is incorrect

- The bank omitted the check deposit on 11/14

18. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

What additional source documents might Zapata need to complete this bank reconciliation? (Select all that apply)

- Credit card statement

- Checkbook ledger

- Bank fees schedule or policy

- Report of checks written but not yet cleared

Shuffle Q/A 2

19. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

Which type of error occurred for the entry on 12/21/20?

- Transpositional

- Omission

- Addition

- Reversal

20. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

What might be a strategy Zapata could use to prevent this from occurring again in the future? (Select all that apply)

- Make sure she is closing out and reconciling all her accounts each month

- Use estimates to close out her books each month, then perform an annual transactional account reconciliation at the end of the year

- Use a software tool, like QuickBooks Online, to minimize human errors

- Perform a balance sheet approach reconciliation each month