21. What may be a reason the ACH Amazon Refund deposit on 3/30/20 was missed on the books? (Select ALL that apply)

- The owner may not have communicated that a return had been made, making it an unanticipated future transaction

- The return may have happened last month, but not been refunded until now. The notation was forgotten when the new month’s books were started

- Automatic deposits and/or transactions are easy to overlook if they are not regularly scheduled events like payroll or loan payments

- Circuit Computer’s bookkeeper is on a leave of absence and you’re filling in. Maybe the other bookkeeper knew to anticipate this transaction, but you wouldn’t have known

22. IF Circuit Computers wrote a check for $12,000 to a vendor for additional supplies on 03/28/20 that had not cleared yet. Where would this be put on the bank reconciliation form that was completed on 3/31/20?

- Balance per Books side, Company error

- Balance per Bank side, Deposits in transit

- Balance per Bank side, Outstanding checks

- Balance per Books side, Fees/Returned checks

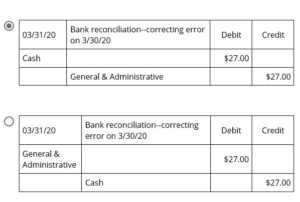

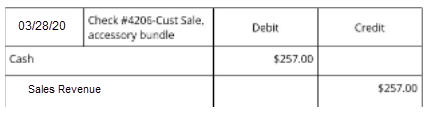

23. If the check deposited on 3/28/20, in the case study workbook, was recorded with the Cash and Revenue portion as seen below instead, which of the following would be true? (Select ALL that apply)

- The cash account would be short $18

- The cash account would be overstated by $18

- The error could be corrected by a single journal entry

- A transposition error would have occurred