Equity and Liabilities Assessment

11. Which of the following best defines a Lien?

- The structured process of paying both the principal and interest over a period of time

- The number of years that it will take to pay back the loan

- The amount of interest that is applied to a loan, annually

- A legal claim on an asset used as collateral in satisfying a debt

12. True or False: An Unsecured Loan is a loan in which the borrower has pledged collateral as part of the loan agreement.

- False

- True

13. Your client has taken out a 15-year loan of $200,000 at 6% annual interest. Their annual installments are $20,252.52. Using the amortization formula, calculate how much of the annual installment payment is going towards the principal for year 1. (your answer should be in the following format and not include a $ sign: xxxx.xx)

8,252.52

14. On the balance sheet, a note payable will appear as a(n):

- Asset

- Long-term Liability

- Current Liability

- Equity

15. Which of the following best describes the term Owner’s Draw?

- The opening balance of an owner’s capital account

- Decreases in equity from owner’s withdrawals.

- Increases in equity from profits or additional capital contributions

- The closing balance of the owner’s capital account

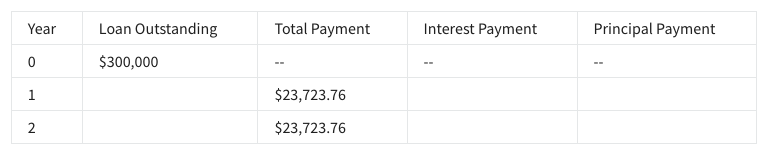

16. Your client has taken out a 20-year loan for $250,000 with a 5% annual interest. Their annual installments are $23,723.76. Using the amortization chart, calculate how much of the annual installment payment is going towards the principal for year 1. (your answer should be in the following format and not include a $ sign: xxxx.xx)

17. Your client has just withdrawn $2,000 from their equity in the company. The accounts affected are the cash account and the Owner’s Draw account. Which of the following is the correct steps to set up the journal entry for this transaction?

1. Debit Owner’s Draw $2,000

2. Debit Cash Account $2,0001. Credit Cash Account $2,000

2. Credit Owner’s Draw $2,0001. Debit Cash Account $2,000

2. Credit Owner’s Draw $2,0001. Debit Owner’s Draw $2,000

2. Credit Cash Account $2,000

18. Your client has taken out a 15-year loan for $300,000 with a 5% annual interest. Their annual installments are $23,723.76. Using the amortization chart, calculate how much of the annual installment payment is going towards the principal for year 2. (your answer should be in the following format and not include a $ sign: xxxx.xx)

Shuffle Q/A 2

19. Which of the following best describes a company with the following attributes?

Ownership: Two or more partners

Capital Contributions: Partner Equity

Taxes: Self-employed taxes; Personal taxes

- Sole Proprietorship

- Limited Liability Company (LLC)

- S Corp

- Partnership

20. Your client secured a short-term loan of $5,000. What would be the correct way to record the initial transaction in the general journal?

- Credit cash $5,000 and credit loans payable $5,000

- Debit cash $5,000 and debit loans payable $5,000

- Debit Cash $5,000 and credit Loans Payable $5,000

- Credit cash $5,000 and debit loans payable $5,000