11. Lou purchased his truck for $32,000. He paid $2,000 cash and took out a $30,000, 5-year loan.

Select the correct journal entry below.

12. The general journal is used to record transactions in chronological order.

Each transaction requires two entries, a credit and a _____.

- debit

13. When creating a journal entry, the following are true.

Select all true statements.

- You can only include two accounts.

- You record credits on the right.

- The credit and debit totals must be equal.

- You record debits on the left.

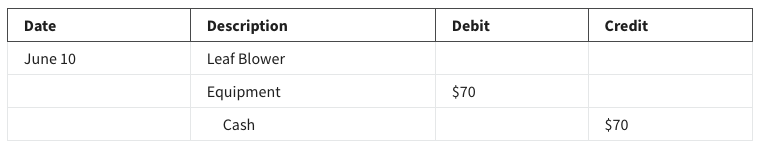

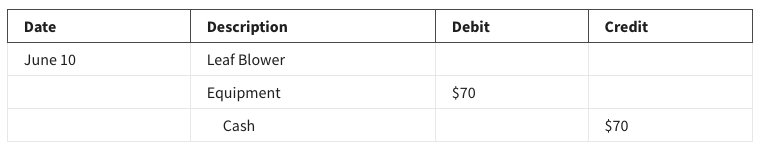

14. In this example, the journal entry shows a(n) _______ in the Equipment account and a(n) ______ in the Cash account.

- increase, increase

- increase, decrease

- decrease, decrease

- decrease, increase

15. This journal entry could represent:

- Purchasing $70 worth of equipment with cash.

- Selling $70 worth of equipment for cash.

- Purchasing $70 worth of equipment on credit.

- Selling $70 worth of equipment on credit.

Accounting Concepts and Measurement Assessment

16. What tasks would a bookkeeper do?

- Manage accounts receivable/payable, recording financial transactions, and implement HR policies

- Record financial transactions, create employee write-ups, and handle bank feeds and reconcile bank accounts

- Handle bank feeds and reconciles bank accounts, managing accounts receivable/payable, and record financial transactions

17. Mary Smith is the owner and operator of Smith Construction. At the end of the company's accounting period, December 31, 2020, Smith

Construction has assets totaling $760,000 and liabilities totaling $240,000.

Use the accounting equation to calculate what Mary’s Owner Equity would be as of December 31, 2020.

(Enter your answer as a whole number. Don't use a decimal, for example $xxx,xxx)

- $520,000

18. Mike Anderson is the owner and operator of Anderson Consulting. At the end of 2019, the company’s assets totaled $500,000 and its liabilities totaled $175,000. Assuming that over the 2020 fiscal year, assets increased by $120,000 and liabilities increased by $72,000, use the accounting equation to determine what Mike’s Owner's equity will be as of December 31, 2020?

(Enter your answer as a whole number. Don't use a decimal.)

- $373,000

Shuffle Q/A 2

19. Maria Garcia owns a software consulting firm. At the beginning of 2019, her firm had assets of $800,000 and liabilities of $185,000. Assuming that assets decreased by $52,000 and liabilities increased by $24,000 during 2020, use the accounting equation to calculate equity at the end of 2020.

(Enter your answer as a whole number. Don't use a decimal, for example $xxx,xxx)

- $539,000

20. The accounting equation can be defined as:

- Assets = Liability / Equity

- Revenue – Expenses = Income

- Assets = Liability + Equity