liabilities and equity in accounting coursera week 3 quiz answers

Long-term Obligations and Notes Payable Practice Quiz

1. True or False: Any money borrowed or owed by a business, regardless of the payback time frame is considered a long-term obligation.

- True

- False

2. Which of the following is not an example of a long-term liability?

- Mortgage Loan

- Vehicle Loan

- Accounts Payable

- Notes Payable

3. If a company decides to split a loan or note payable on their balance sheet, which of the following would go as a line item in current liabilities?

- The total amount due on the long-term obligation in the next month.

- The total amount due on the long-term obligation in the next 6 months.

- The total amount due on the long term obligation in the next 8 months.

The total amount due on the long term obligation in the next 12 months.

Bank Loans Practice Quiz

4. A legal claim on an asset used as collateral in satisfying a debt is called a:

- Held Asset

- Lien

- Collateral Asset

- Secured Asset

5. The process of systematically repaying a loan over time is referred to as:

- Amortization

- Depreciation

- Capitalization

- Indemnification

6. A loan used to finance a company’s daily operations is called a(n):

- Unsecured Loan

- Commercial Line of Credit

- Working Capital Loan

- Secured Loan

Stockholder Equity Practice Quiz

7. Owner’s equity is calculated by:

- Adding up all of the business assets and deducting all of its liabilities.

- Adding up all of the business liabilities and deducting all of its assets.

- Subtracting all of the business assets from its liabilities.

8. If a company has $80,000 in total assets and $40,000 in liabilities, the owner’s equity is ______.

- $80,000

- $40,000

- $20,000

- $60,000

9. You record an owner’s draw by _____ the Owner’s Draw Account and _____ the Cash Account.

- crediting; debiting

- debiting; debiting

- crediting; crediting

- debiting; crediting

10. At the end of a fiscal year, Winston’s Seafood had draws totaling $8,000. What is the first step in closing the draw account for this fiscal period?

- Crediting $8,000 to the Owner Withdrawals account.

- Crediting $8,000 the Owner Capital account.

- Deducting $8000 from the Owner Equity account.

Equity and Liabilities Assessment

11. Which of the following best defines a Lien?

- The structured process of paying both the principal and interest over a period of time

- The number of years that it will take to pay back the loan

- The amount of interest that is applied to a loan, annually

- A legal claim on an asset used as collateral in satisfying a debt

12. True or False: An Unsecured Loan is a loan in which the borrower has pledged collateral as part of the loan agreement.

- False

- True

13. Your client has taken out a 15-year loan of $200,000 at 6% annual interest. Their annual installments are $20,252.52. Using the amortization formula, calculate how much of the annual installment payment is going towards the principal for year 1. (your answer should be in the following format and not include a $ sign: xxxx.xx)

8,252.52

14. On the balance sheet, a note payable will appear as a(n):

- Asset

- Long-term Liability

- Current Liability

- Equity

15. Which of the following best describes the term Owner’s Draw?

- The opening balance of an owner’s capital account

- Decreases in equity from owner’s withdrawals.

- Increases in equity from profits or additional capital contributions

- The closing balance of the owner’s capital account

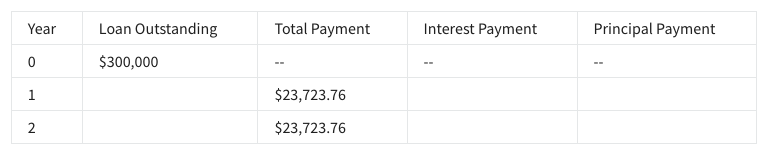

16. Your client has taken out a 20-year loan for $250,000 with a 5% annual interest. Their annual installments are $23,723.76. Using the amortization chart, calculate how much of the annual installment payment is going towards the principal for year 1. (your answer should be in the following format and not include a $ sign: xxxx.xx)

17. Your client has just withdrawn $2,000 from their equity in the company. The accounts affected are the cash account and the Owner’s Draw account. Which of the following is the correct steps to set up the journal entry for this transaction?

1. Debit Owner’s Draw $2,000

2. Debit Cash Account $2,0001. Credit Cash Account $2,000

2. Credit Owner’s Draw $2,0001. Debit Cash Account $2,000

2. Credit Owner’s Draw $2,0001. Debit Owner’s Draw $2,000

2. Credit Cash Account $2,000

18. Your client has taken out a 15-year loan for $300,000 with a 5% annual interest. Their annual installments are $23,723.76. Using the amortization chart, calculate how much of the annual installment payment is going towards the principal for year 2. (your answer should be in the following format and not include a $ sign: xxxx.xx)

19. Which of the following best describes a company with the following attributes?

Ownership: Two or more partners

Capital Contributions: Partner Equity

Taxes: Self-employed taxes; Personal taxes

- Sole Proprietorship

- Limited Liability Company (LLC)

- S Corp

- Partnership

20. Your client secured a short-term loan of $5,000. What would be the correct way to record the initial transaction in the general journal?

- Credit cash $5,000 and credit loans payable $5,000

- Debit cash $5,000 and debit loans payable $5,000

- Debit Cash $5,000 and credit Loans Payable $5,000

- Credit cash $5,000 and debit loans payable $5,000

21. Which of the following best describes a company with the following attributes?

Ownership: One person

Capital Contributions: Owner’s Equity

Taxes: Personal taxes

- Limited Liability Company (LLC)

- S Corp

- Sole Proprietorship

- Partnership

22. A loan in which the borrower has pledged some asset as collateral is known as a(n):

- Unsecured Loan

- Mortgage Loan

- Working Capital Loan

- Secured Loan

23. True or False.: When a company takes out a loan to purchase a vehicle or equipment, the value of the vehicle or equipment should be listed on the balance sheet as an asset.

- True

- False.

24. Which of the following is the correct accounting equation to use when determining equity?

- Assets – Liabilities = Equity

- Assets + Liabilities = Equity

- Assets = Liabilities + Equity

- Asset * Liabilities = Equity

25. The percentage of the existing principal loan balance that the borrower must pay the lender for borrowing the money is referred to as the:

- Refinance Rate

- Mortgage Loan Rate

- Interest rate

- Prime Rate

26. You are working on a balance sheet for your client. Currently, you have a total asset value of $51,500 and a total liability value of $7,500. Using the accounting equation, what would your total equity value be? (type your answer as a whole number without punctuation)

27. The multi-column chart listing each payment required during the loan period is called a:

- Loan Amortization Schedule

- Depreciation Schedule

- Loan Defrayment Schedule

- Mortgage Repayment Schedule

28. On the balance sheet, if your client splits their loan into long-term liabilities and current liabilities, which of the following would be the value that would be placed in the current liability section?

- The total amount due on the loan over the next six months

- The total amount due on the loan over the next month

- The total amount due to interest over the next twelve months

- The total amount due on the loan over the next twelve months

29. True or False: A mortgage loan generally requires the real estate to serve as collateral, but commercial loans generally may or may not have an asset associated with the loan to put on the books.

- True

- False

30. Which best defines amortization?

- The systematic process of repaying a loan over time

- The systematic process of depreciating assets over time

- The systematic process of calculating the interest payments

- The systematic process of financing the company’s daily operations